Will the Lithium Price Boom Again?

LITHIUM ANALYSIS

The Lithium price has long been subject to complex supply chains involving the growing demand for energy storage, and the constant surges in EV sales. However, undercutting this demand is a limited supply of battery grade resources, which puts a company already in production in prime time. In short, Lithium price volatility continues but the fundamentals remain strong. The critical key to successful investing is looking through the short to longer term.

Below are two graphs that illustrate the dynamics driving the growth in the share prices of stocks in the sector.

If you are interested in learning more about the mining sector and how to invest in this area, read more here.

If you are interested in learning more about the mining sector and how to invest in this area, read more here.

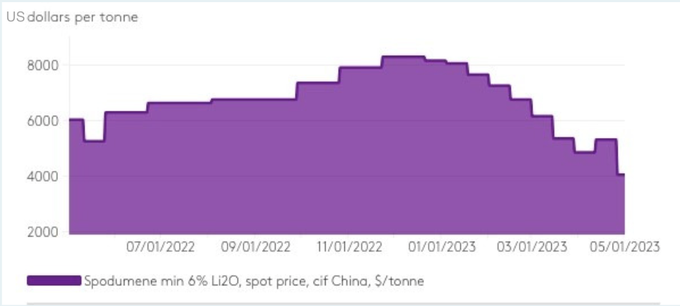

Spodumene and Lithium Hydroxide Prices

One of the key raw materials in producing batteries, Lithium hydroxide, is processed from a spodumene (an ore which averages 6% lithium) concentrate. In Australia, Pilbara Minerals (PLS), leads the market in spodumene production at its Pilgangoora project in Western Australia.

Start investing successfully in fast growth ASX Small Caps now with Under the Radar Report.

Spodumene did not participate in this overall recovery. Over the same period, spodumene prices fell from $US8,000 a tonne to US$4,000-4500 a tonne. However, analysts say they continued to weaken in June, being too high for downstream lithium producers to be sufficiently profitable. By July, the restocking largely ended.

WE EXPECT STRONGER LITHIUM PRICES LATER THIS YEAR

WE EXPECT STRONGER LITHIUM PRICES LATER THIS YEAR

Some East Asian battery cell manufacturers are planning higher production capacity in the second half of 2023, supporting a forecast of further robust demand for hydroxide in the global lithium supply chain.

While there has been a fall this past year, historically, the current lithium price is very good. Spodumene fell from US$900 a tonne in 2018, to US$500 a ton in 2019, and rose sharply from an average US$675 to over US$2000 in 2021.

The current spot market price has come off from its high of US$8,000, but still remaining very high at US$4,000 and are partly a reflection of an immature market. Over the long-term, prices will be lower, which is factored into stock market share valuations.

The lithium market is volatile, but supply is tight and the imperative for decarbonisation and electric vehicles is high. Politicians and government need to be seen to be doing something to stop the ravages of climate change and rising fuel prices.

Are you ready to invest in Blue Chip Stocks now?

Get access on our best stocks to buy now. 14 days free. No credit card required just enter your email and you're away.

VOLATILITY MEANS OPPORTUNITY

The high spodumene price being reported by hard rock lithium producers such as Pilbara Minerals (PLS) are not expected to be a permanent feature, with analyst forecasts factoring in declines for prices in future years. When PLS reported a realised spodumene price fall in its latest production report, there was an element of surprise in the data in terms of the extent of this drop, but directionally, it was predictable.

The volatility we are currently seeing in price, which will be a feature from time to time, has a flow on affect on lithium equities. This is what we regard as buying opportunities to get your portfolio exposed to this once in a lifetime event.

For the Ultimate Guide to ASX Lithium Stocks

SUBSCRIBER TAKEOUT

Subscribe now to get the key actions for ASX investors to take!

:quality(75))