Why invest in blue chip stocks?

Blue chip stocks refer to large, established companies typically recognised as ‘best in class.’ Like the blue chip on a poker table, these publicly traded companies are leaders in their industry and boast a consistent history of growth and stability.

The benefits of Australian blue chip shares

Blue chip shares are generally perceived as a less risky alternative to small-cap investments. However, their benefits can be far more nuanced:

Capital growth — Unlike traditional savings accounts with diminutive returns, blue chip stocks can hedge your bets against inflation. The average interest deposit rate for a bank in Australia is currently 1.56%. In contrast, the historic yield of blue chip stock averages between 5% and 6%.

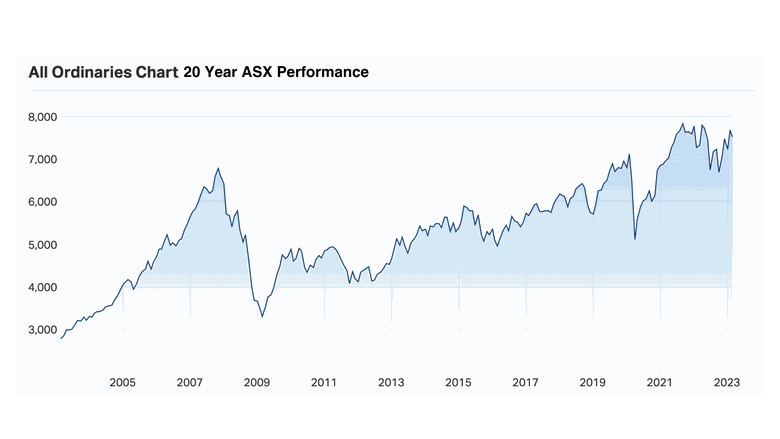

Historic resilience — Large-cap stocks in the Australian market typically show greater resilience against bear markets. They are often perceived as a lower-risk investment, which means they may be suitable for conservative investors or individuals nearing retirement.

Biannual dividends — Australian blue chip stocks typically yield biannual profits paid in dividends. This ensures your investment grows at a faster rate than traditional bank accounts.

Sustainable yield — Blue chip stocks on the ASX trend upwards every nine in ten years. As share prices increase, demand also increases, leaving you in a good position for growth. Although it's always possible for a blue chip stock to fail (like the Eastman Kodak Company in 2016), cases like this are exceedingly rare.

Tax advantages — Investing in blue chip stocks may unlock access to franking credits, which may be received as a tax refund. Franking credits are not available to funds stored in a typical bank account.

Examples of blue chip stocks in Australia

Blue chip stocks come from well known and global brands with large valuations or market capitalisations. You will be familiar with these names:

BHP Group (BHP) — Established in 1885 near Broken Hill, New South Wales, BHP is a major supplier of metals, petroleum and natural gas. With a 138 year history, the company is the second-largest mining company in the world. Its current value is estimated at $169 billion.

Commonwealth Bank of Australia (CBA) — The CBA is currently the largest bank in Australia. Thanks to its proven track record of sustainable returns, it is also one of ASX's most popular blue chip stocks. Its current market cap is estimated at $186 billion.

CSL Limited (CSL) — CSL is a biotechnology company known for creating a vaccine for the Spanish Flu. Today, the company specialises in developing treatments for iron deficiency, nephrology, and rare or serious diseases. Its estimated market cap is positioned at $147 billion.

How to integrate blue chips into a larger portfolio

Blue chip stocks are historic dividend producers that lend themselves well to various strategies. That said, diversification should be the primary goal of any investment portfolio. It’s important to do careful research before jumping into any specific investment.

Under the Radar’s Blue Chip Value report is a great place to start. Once you sign up for our 14-day free trial, we’ll deliver a comprehensive blue-chip report every second Friday morning. Our highly skilled analysts will walk you through their fundamental research and quantitative analysis regarding key opportunities and highlight whether you should buy, sell or hold to better manage your portfolio.

Learn more about how our Blue Chip Value Portfolio outperforms the S&P/ASX 200 by more than three percentage points.