Banks & Retail: Which stocks should you own?

Today we drill down on how interest rate rises, inflation, property prices and supply chain issues are impacting the banks and the big supermarket retailers.

ACCESS our FAVOURITE Big Banks and Retailers among our top 40 Blue Chip Stocks, here.

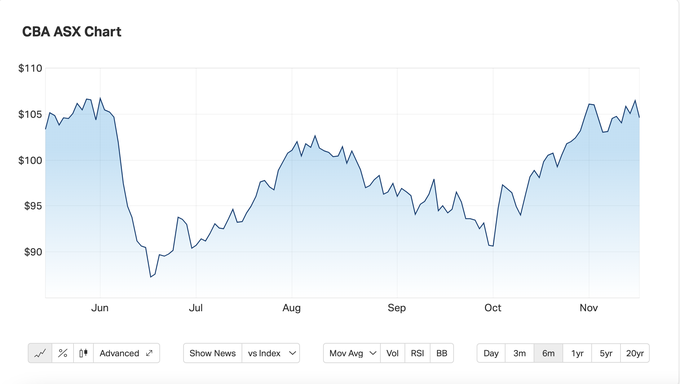

Find out about the BIG ASX stocks, CBA, NAB, WBC, WOL and COL. We show you how to beat the market with our favourite bank and retail stocks.

The great strength of Blue Chip Value is the marriage of macro or top down insight, and company specific fundamental analysis.The great strength of Blue Chip Value is the marriage of macro or top down insight, and company specific fundamental analysis. We drill down on how interest rate rises, inflation, property prices and supply chain issues are impacting the banks and the big supermarket retailers.

The first thing to say about the banks is that they’re all, more or less, coping well with increasing labour costs and benefiting greatly from rising interest rates.

We believe that, all things, being equal, the headwind of rising costs will continue to be eclipsed by the benefits of interest rate rises in the form of increasing income and wider net interest margins. The banks’ profitability is going to continue to improve. Combined with the fact that they are dividend machines, they continue to be very good value.

We believe that, all things, being equal, the headwind of rising costs will continue to be eclipsed by the benefits of interest rate rises in the form of increasing income and wider net interest margins. The banks’ profitability is going to continue to improve. Combined with the fact that they are dividend machines, they continue to be very good value.

What our numbers say

The big banks are trading on a running dividend yield of 5.5% and three are very good value.

The banks have unique qualities in the form of franking credits, they’re an oligopoly, which means they can hold onto the majority of the boost to income provided by rising interest rates; and they have very strong balance sheets.

Find out which outperforming banks to Buy Now!

Get into our research now. Start acting on our best stocks to buy research for 14 days free. No credit card required just enter your email and you're away.

The Big Picture

On the other hand, we cannot ignore the fact that we remain in the midst of a cycle of interest rate rises. The latest data shows that nominal GDP, a proxy for demand in both the Australia and US economies is growing at 10% a year. While the US overnight official interest rate, the “cash rate” is at 4%, Australia’s is well behind at 2.85%. Inflation in both countries is nudging 8%.

The US Federal Reserve is considered to be ahead of the curve, while our own RBA is considerably behind it, as far as attacking inflation is concerned. But what does this mean? Simply that in the future we will be forced to raise rates faster and harder than anticipated, which will cause forced sales in property.

What about retail stocks: COL & WOW?

Coles (COL) and Woolworths (WOW) have now produced quarterly numbers that show food inflation well over 7%. This is on top of increasing energy prices and rising rental and mortgage costs, the latter is lumpy, as fixed rate mortgages role off.

A key factor for the big retailers, however, is that the cause of the food price inflation is a supply side shock in the form of floods. There are also supply chain difficulties, but the root cause is the difficulties being experienced by the producers. There could be extended pain on this front, but it is transitory.

Portfolio Comment

Summary

As I said last week, Blue Chip Value is about exploiting the virtues of diversification and stock picking. At this end of the spectrum you need to have a solid framework of macroeconomic analysis, which is why having an economist on our team is so valuable! Last, to achieve the most bang for your buck you need to look towards the future, and those market disruptors. This is where Small Caps come in.

Three Attributes We Look For In A Blue Chip

1. The company is not expensive on a Price to Book ratio

You are simply looking at the share price divided by the net assets per share. This methodology comes up with the same result as the simple PE or price earnings ratio, but is preferred because it is more easily comparable across industries. This involves some work because you are stripping out a lot of accounting related non-cash profits and expenses.

2. Strong Operating Profitability

Under the Radar focuses on cash flow return on assets because it’s similar to Return on Assets but is more focussed on cash flow. Once again we are stripping out the non-cash accounting related effects to get back to what a company is really getting as a return from its past investments.

3. Avoid companies that are heavily reinvesting excess cash flow or free cash flow back into the business

We don’t like big “capex humps” coming up where a company is set to spend huge amounts on assets.

ACCESS our FAVOURITE Big Banks and Retailers among our top 40 Blue Chip Stocks. Join for just $20 a month now