Lithium Stock ALLKEM (AKE) announces merger

Lithium producer

Rating: Hold (downgrade from spec buy)

ASX code: AKE

Share price: $15.06

Market cap: $9.5BN

Net cash: US$578m (A$855m)*

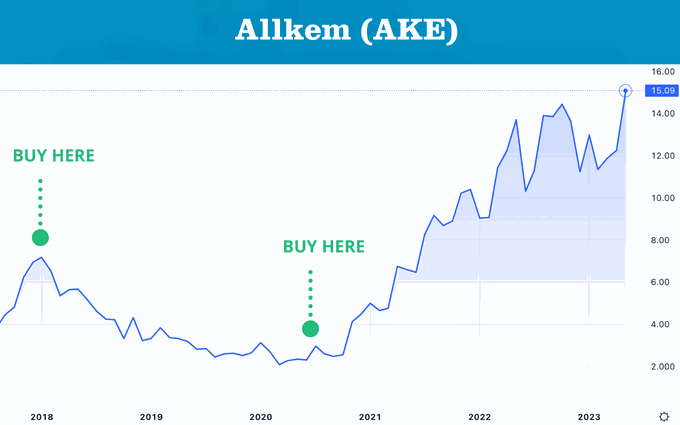

Tip date: 27 Jan 2018*

Tip price: $6.99

*Company then knowns as Orocobre.

ALLKEM STOCK ANALYSIS

Allkem has a great pipeline, but may have struggled to meet its targets in the same timeline that it would with the addition of the US based Livent (NYSE: LTHM). Mining is all about scale and the combined group produces a lithium powerhouse, being the third biggest in the world, which delivers more operating leverage to shareholders. Also, Livent is very advanced with its lithium processing technology.

The merger is very much one of equals, which is why we are content to hold on for the benefits. AKE has had a good run. Hold for the time being, but further out in time we envisage the group delivering strong returns.

Livent needed an acquisition and AKE fits the bill. But we don’t think that this is the end of the story. In Canada there are so much active exploration for lithium (hard rock) that the group will almost certainly be looking to add to its existing projects.

To read more about Lithium, please click here

THE DEAL

The AKE and Livent merger creates a leading global chemicals producer valued at US$10.6bn (A$15.7bn) with pro-forma CY22 combined revenue of US$1.9bn and adjusted EBITDA of US$1.2bn.

In the merger, AKE shareholders will receive one share in the new entity for each existing AKE share. Livent shareholders will receive 2.406 shares in the new entity for each existing Livent share. AKE and Livent shareholders are expected to own 56% and 44% of the combined company respectively.

We identify and research quality ASX Small Cap stocks to buy now. Access our Small Cap report for just $59 a month!

DETAILED ANALYSIS

Based on current production and scheduled projects, production from the merged AKE/Livent entity is expected to reach 248k tonnes a year lithium carbonate (LCE) by CY27, making it the third largest listed global lithium producer after Albemarle (343k tonnes a year) and SQM (302k tonnes a year).

While the merger appears sound and logical, is it a good deal for shareholders? We think it is.

Under the merger, AKE’s major growth projects, that is Sal de Vida 2, Olaroz/Cauchari 3, and James Bay are scheduled to be completed by CY27. AKE did not have any firm dates for these projects. Hence the merger has the effect of accelerating the delivery of these projects.

Funding all these projects could have been a challenge for AKE on its own. The larger merged group will have a stronger balance sheet combined cash flow to do this.

There is geographical locational advantage with both companies having operations or projects in Argentina and Canada. This asset proximity is expected to achieve one-time capital savings for the company’s developments of approximately US$200m, with co-development now possible.

There will also be operating synergies with an annual run rate of approximately US$125m. Additional synergies are expected beyond CY27.

Further, Livent is a lithium chemical manufacturer already and has the skills and capacity to process AKE’s products further downstream and derive extra margin. AKE needed to find customers for its product, some of which would have captured the additional value added themselves.

In addition, Livent has mastered Direct Lithium Extraction (DLE) and uses it at its operations. This is its edge, which other companies are emulating such as Lake and Rio, although probably using a different form of DLE. Livent’s DLE has the potential to be used at Sal de Vida 2 and Olaroz/Cauchari 3, reducing capital costs, replacing evaporation ponds and potentially delivering a higher value product.

Livent was known to be looking at potential acquisitions before AKE. The larger group will be able to continue to look at further acquisitions.

Access our favourite Lithium stocks today. Subscribe to our Small Cap report for just $59 a month!