Market Insight: Three Niche Gas Stocks

The international market for gas has been upended this year with Russia’s invasion of Ukraine. Unlike oil, gas is less transportable on a global basis. Gas markets are still much more localised, which means that there are opportunities for smaller players to fill niches. Below we list THREE small cap stocks to watch.

Learn more about Small Caps Investing and why we picked these ASX Small Cap gems and their outstanding performance.

Three Small Cap Gas Stocks

There are a number of small gas producers and developers on the ASX. The ones listed below we believe are uniquely positioned to benefit from the gas price rises, albeit with varying degrees of risk.

These are early-stage listed domestic gas developers. Blue Energy has the most appeal because of its large asset base and executed supply agreements with key retail providers and industrial users.

Blue Energy (ASX:BLU)

Aspires to be the next east coast domestic gas supplier. Main gas assets in the Bowen Basin North and South plus assets in the Beetaloo Basin and Galilee basin. Gas supply agreements for 500 petajoules. Infrastructure providers looking to underwrite gas pipelines to link with its gas assets.

Aspires to be the next east coast domestic gas supplier. Main gas assets in the Bowen Basin North and South plus assets in the Beetaloo Basin and Galilee basin. Gas supply agreements for 500 petajoules. Infrastructure providers looking to underwrite gas pipelines to link with its gas assets.

Before you invest in any stocks, get our latest buy, sell and hold recommendations, on our favourite small cap growth stocks, for only $59 a month. Join Now!

Galilee Energy (ASX:GLL)

One of the largest uncontracted resource positions on the East coast. Water production has been a challenge. Seeking to reuse water for applications such as agriculture. New management team.

One of the largest uncontracted resource positions on the East coast. Water production has been a challenge. Seeking to reuse water for applications such as agriculture. New management team.

Vintage Energy (ASX:VEN)

Cooper Basin gas assets at Vali (VEN share 50%) and Odin close to Moomba connected infrastructure. Also a CO2 gas resource at Nangwarry capable of supporting commercial supply. Changing from exploration company to producer with first gas sales from Vali to AGL from 4Q22. Odin to be drilled in FY24.

Cooper Basin gas assets at Vali (VEN share 50%) and Odin close to Moomba connected infrastructure. Also a CO2 gas resource at Nangwarry capable of supporting commercial supply. Changing from exploration company to producer with first gas sales from Vali to AGL from 4Q22. Odin to be drilled in FY24.

If you are interested in learning more about the mining sector and how to invest in this area read more here.

Gas sector: Special Report

The Russian Effect

Historically the Nord Stream gas pipelines that run under the Baltic Sea from Russia to Germany supplied about one third of Russian gas exported to Europe. Then at the start of September it was closed indefinitely, ostensibly for maintenance. Prior to shutting its operating rate had declined to 20% of its capacity. Another major route for Russian gas supply is through Ukraine, which has not stopped but is running at lower levels.

The EU has been active in sourcing alternative supplies to refill gas storage facilities for winter. In August, 48 out of 84 LNG cargoes from the US landed in Europe, with France the top destination for the second month in a row.

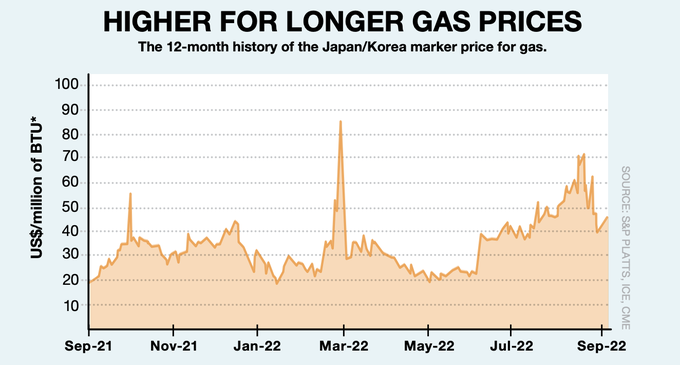

Also in August, European spot gas prices and Asian spot LNG prices hit record levels due to near-term uncertainty over gas supply. They then retreated somewhat before a strong recovery in early September with the latest Nord Stream shutdown.

The Price Effect

Gas prices have been extremely volatile. However, high European underground gas storage levels, at over 80% of capacity, have eased supply concerns in the market. Generally, gas prices are 400% higher than a year ago and we believe that they will be stronger for longer owing to this almost unprecedented uncertainty, which does have a knock-on effect for domestic gas prices.

Australian Gas Shortages

Australian Gas Shortages

Across the country there is a growing supply shortfall through to the end of 2030. Adding to the uncertainty is the fact that around 40% of future assumed production is from undeveloped reserves.

The domestic market is exposed to the volatility in international gas and oil markets where the gas is uncontracted. Prices received are based on the LNG netback price, which climbed to A$67.81/gigajoule in the past month, having traded at levels close to $10 for much of the past five years.

Given the large difference between LNG netback prices and domestic gas prices, there is a strong incentive for a company not to lock in all its gas production into long term contracts.

Want to know which ASX Gas stocks to buy?

Get access of the in depth market research and analysis. See the TWO east gas producers we recommend as a BUY...

:quality(75))