Why Uranium ASX stocks are set to profit

REACTORS SET TO DOUBLE

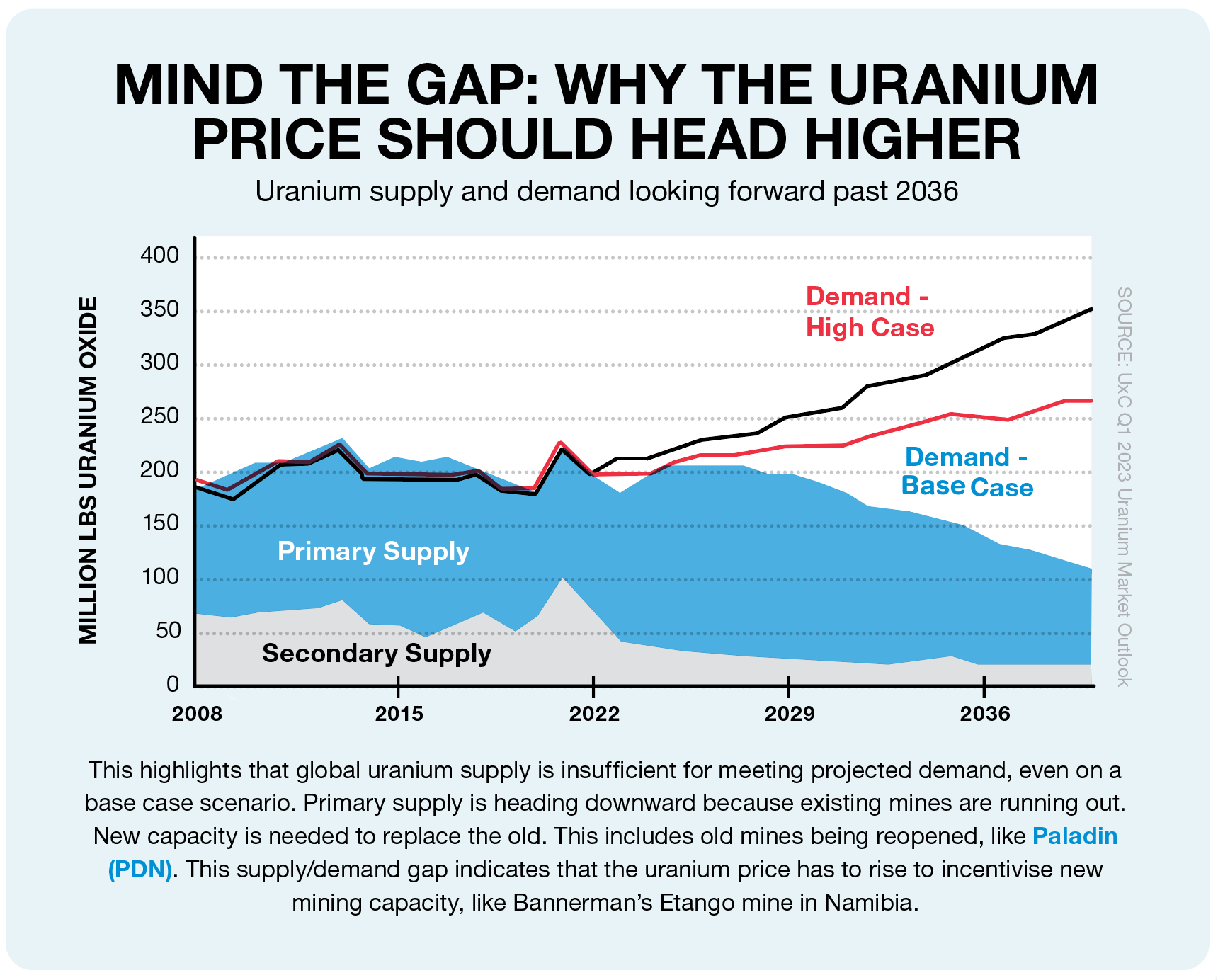

There are close to 450 nuclear reactors worldwide, with a further 60 reactors under construction, 40 more planned and proposals for a further 300. What does this mean? Demand for uranium is rising, but supply is actually diminishing. Only a higher uranium price will avert this widening demand supply gap. Market forces eventually dictate sensible outcomes. The question is always over the timing of such events. Access our favourite Uranium stocks today.

WHY SENTIMENT IS IMPROVING FOR NUCLEAR ENERGY

Nuclear power stations are simple – you have a plant, which requires uranium feedstock. It’s reliable and can deliver consistent power. Compare this to the complexity and uncertainty inherent in wind and solar and it’s easy to understand why nuclear should have a place in a low carbon world. New installations are proving that safety is no longer an issue.

GOVERNMENT NUCLEAR SUPPORT

In North America, the scale of the uranium mining and exploration industry in Canada is a significant feature. The US has pledged greater cooperation to support the development of secure nuclear fuel chains and the installation of Small Modular Reactors (SMRs).

In Europe, Germany has closed its power stations but most of the other countries are adopting nuclear. France has announced the planned creation of a pro-nuclear alliance with 12 European countries to advocate for nuclear power in EU politics.

In Japan, the government has adopted a plan to allow companies to operate nuclear reactors beyond the existing 60-year limit and to build next generation nuclear reactors to replace plants that have been decommissioned.

The China National Nuclear Power Co. has announced plans to invest US$12bn in nuclear energy this year alone, a 60% increase on the prior year. China currently has 24 nuclear power plants under construction with a combined capacity of 26.81M KW.

The UK has also committed to a program of new nuclear reactors. Read more on uranium from our mining experts here.

INVESTMENT SUMMARY

The stocks we like are those that can benefit the fastest from any uranium price rise. These companies are not just a concept, but are at advanced stages of project development, with tangible paths to production. Paladin Energy (PDN) and Boss Energy (BOE) have already set dates for reopening their plants. We cover Bannerman Energy (BMN) below, which is on target to be producing in 3 years. Lotus Resources (LOT) hasn’t announced a date, but can open quickly, 15 months, from a final investment decision.

Access our favourite Uranium stocks today. Subscribe to our Small Cap report for just $59 a month!

:quality(75))

:quality(75))

:quality(75))