7 Steps to Building a Successful Dividend Portfolio

Stocks with strong fundamentals can give you a dividend yield much more than interest rates AND the shares remain cheap enough to offer big potential for capital gain as the valuation goes from being dividend based on current value to growth based on future expectations.

Positive results during a difficult 2022, highlight that a portfolio supported by strong dividends works no matter the share market environment.

We have been publishing dividend portfolios for subscribers based on our best dividend paying ideas since 2016 and many subscribers will have benefitted from the two to three stocks in each of the early portfolios that have returned more than 100%. Below are 4 takeaways:

1. Small Caps get taken over

We have recommended 12 Small Cap Dividend Portfolios over the past five and a half years, which includes 16 stocks that have doubled or more.

It’s telling that 11 of these stocks have been taken over. In our first portfolio in January 2017 of the 9 stocks in the portfolio, five have been taken over, four having doubled on our entry price.

We’re not the only ones who do fundamental analysis! For instance, PTB Group (ASX:PTB) was included in the three most recent portfolios, and despite the poor market, PTB was taken over, at a price much more than double our original recommendation and provided an attractive yield in the meantime. We try to think about stocks in terms of the attractiveness of their underlying business, not only on a stand-alone basis, but also in strategic terms.

Under the Radar Report, big corporates and private equity are all hunting for stocks that are profitable, cash flow positive, and are cheap enough that the share of earnings paid out as dividends still represents an attractive return, usually paid twice a year, that can also include valuable tax credits.

Most of the Under the Radar Report dividend portfolios have outperformed the S&P/ASX All Ordinaries and the S&P/ ASX Small Ordinaries indexes over that period, reinforcing the power of selecting companies based on sustainable dividends to deliver strong results in most market conditions.

2. Strong balance sheets matter more than ever

We aim to identify and recommend companies with strong balance sheets and the capacity to increase dividends over time, from existing earnings, and this strategy has protected the performance of our small cap dividend portfolios from the worst consequences of this bear market.

The upcoming FY23 half year results should also deliver more recent news of cash flow and profitability, which we are confident will favour investors in companies with the fundamentals to deliver profitability and return some of that to shareholders in the current period, with the prospect of growth in periods ahead.

Many smaller companies are not dependent on general economic conditions to grow their business, either because they are winning market share, or because they service sectors that are less affected by the overriding share market valuation parameters of interest rates and sentiment. And by definition, stocks paying dividends from underlying earnings which deliver market beating yields are not expensive, which means they already have the valuation parameter on their side.

Stocks that have appeared in a number of recent portfolios include:

Southern Cross Electrical (ASX:SXE)

GR Engineering (ASX:GNG)

PTB Group (ASX:PTB)

Capral (ASX:CAA)

These stocks have all delivered attractive returns in a difficult market, and consistently paid dividends in line with or ahead of our expectations. In 2022 even the stocks that have not outperformed have shown resilience based on their capacity to pay dividends, the payment of which noticeably improved their returns

Even stocks in the dividend portfolio recommended at the market’s peak in November 2021 have mostly paid the yields we forecast, even though some in cyclical sectors have seen some share price falls. In many cases, this has made the ongoing yield even more attractive, for instance:

HT&E (ASX:HT1)

Austal (ASX:ASB)

3. Buy 9+ stocks for diversification

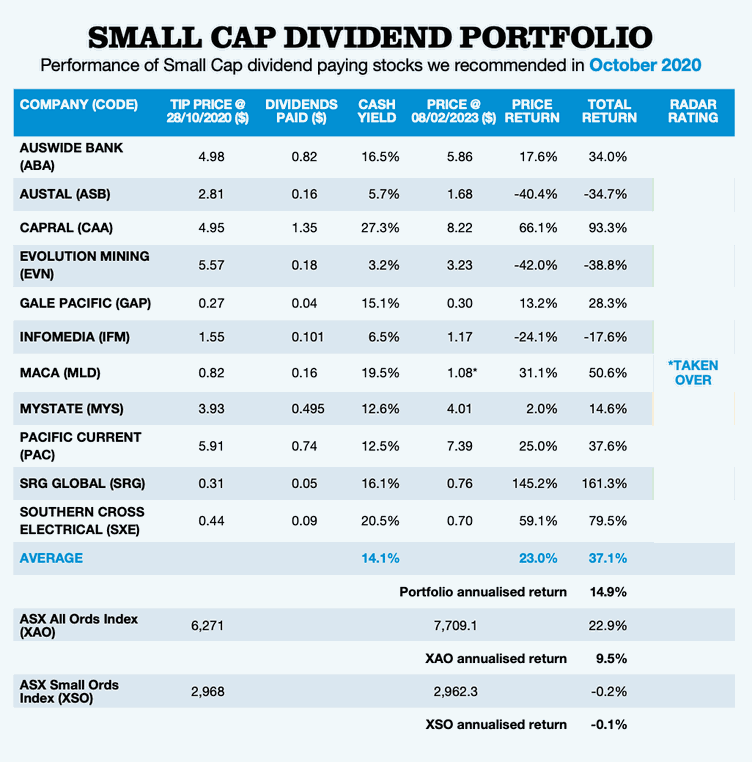

October 2020 Small Cap Portfolio

Total Return of 37.1%. To access the full list of Portfolios, and the buy, sell & hold recommendations for each stock, Join Now!

The best performing portfolios have had more stocks i.e. 9 plus, which illustrates some of the benefits of diversification. Diversification is not only important to spread the individual stock risk, but it is also important to spread your risk across sectors, across industries, across business models, and expose the portfolio to different models of financial leverage.

All portfolios comfortably outperformed the broad S&P/All Ordinaries Index, as well as the S&P/ASX Small Ords index, in some cases by 3-fold.

Two points need to be made:

The performance of more recent portfolios and indexes have been negatively affected by climbing interest rates.

These indexes are not accumulation based, which means dividends weren’t re-invested.

4. Trading for dividends

Averaging down is a technique to increase your exposure to stocks where the fundamentals are robust, but sentiment has turned against particular unfashionable situations. This is something that takes experience and analysis. Under the Radar Report has consistently demonstrated that patience can deliver great results as long as you continue to pay attention to individual company prospects.

When stocks fall, our analytical antennae quivers. It is imperative to identify and understand fundamental factors that are not part of the market view as represented by the share price. During the Covid crisis in March 2020, we were all ready to get to work to find and recommend stocks based on fundamentals. This resulted in two baskets of stocks for subscribers who were trying to make sense of unprecedented circumstances.

Critically, we identified a buying moment in the fog of market panic that served subscribers very well.

Want to See the Full Guide?

If you want to access the final three steps, complete with stock recommendations and yearly portfolio reviews join now for just $59 a Month.