Building a Portfolio of shares

Start building up a portfolio of shares over time. The stock market is one of the biggest generators of wealth around.

5 or 6 Core Stocks

Build a core of 5 to 6 large holidings in stable businesses

8 Quality Small Caps

Small Caps are great for diversification. Add exposure to different risks and industries

6 Satellite Small Caps

Grow your wealth with fast growth Small Caps

Small Caps will boost your investment returns and position your portfolio for growth

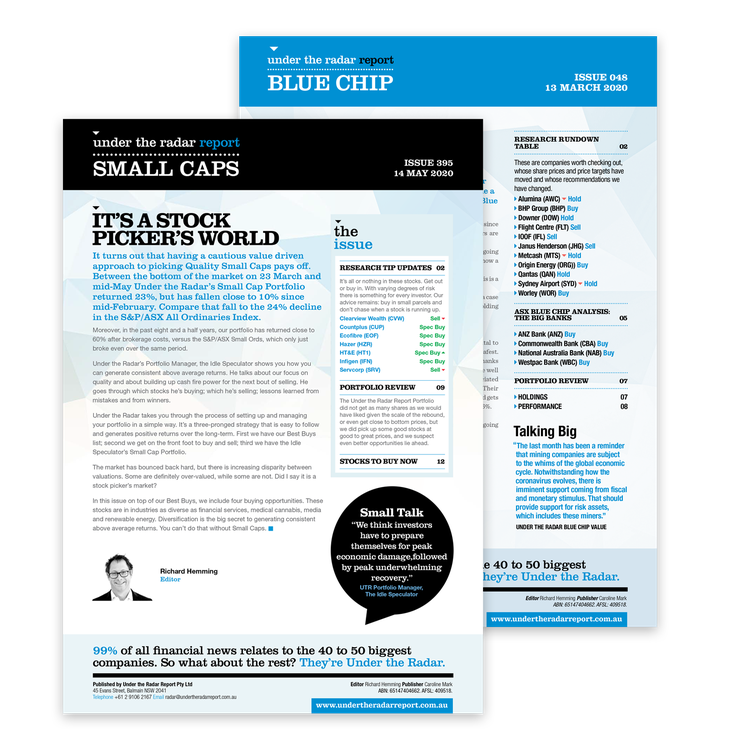

Under the Radar Report provides the stock research to help investors confidently choose which Small Cap shares to buy.

We provide a weekly stock report with ongoing updates advising you when to Buy/Hold/Sell your ASX shares.

How to choose which Small Cap shares to buy

The stock market is saturated with advice on which ASX shares to buy, but where is the research on ASX small caps?

This is why Richard Hemming started Under the Radar Report because of the investment opportunities in Small Caps but there wasn't any quality research for individual investors. We recognise it can be challenging to choose which shares to buy, especially if you are new to investing.

That is why Under the Radar Report provides you with expert ASX Small Cap share research to help you confidently choose your Small Cap shares. We provide weekly updates advising you when to Buy/Hold and Sell your Small Cap shares.

We also have an easy to read 'Best Stocks to Buy' table which is published each week in our stock report. These are the Small Cap stocks our team of analysts agree offer value for money and the best risk/reward return right now.

Increase your ASX share returns now with Small Caps

Start investing now in ASX Small Caps because it's much easier for a small company to double or tripple in size than for a big company to grow by 5% or 10%. Access this week's 10 best stocks to buy and access your free trial now for 14 days.

At Under the Radar Report: Small Caps, we look for value, which means a company that is covering its costs, but has an option on greatness. These kinds of investments aren't found anywhere else.

Take control of your investing

If you want to start investing in shares now check out our best blue chip stocks to buy now

The 7 step process for choosing Small Cap stocks

1. Look for growing sectors

One of our analysts used to be a gaming analyst, rating companies that operated casinos, poker machines and wagering businesses. It became clear that no matter how good the management was, it didn't make a difference. Anti-smoking laws and a general crackdown via increased regulation by the state of gambling meant that the profits of the whole industry were contracting. It is always good to have a top down view of things.

2. Small Caps: Cash is king

In the financial crisis it was obvious, but the rule always applies: Cash is king. No matter how rosy the investment climate may look, it is important to look at the balance sheet to see what financial engineering is going on behind a company's returns. If you are in an investment for the long term, you want to be sure that the assets the company lists can be sold and that it is producing a solid amount of cash after paying for its day to day requirements as well as those necessary to ensure its profits grow in the future.

The ratios we like to look at include a company's book value (its net assets), its forecast price earnings ratio – with an emphasis on the E in PE, and the amount of interest it is forecast to pay, relative to its earnings before interest payments and tax.

In the case of mining companies and biotechs, there is a different orientation. Here we look at the cash burn rate and what the likelihood of raising capital is. Raising equity isn't the worst thing in the world, but you want to know that there are performance hurdles the company will meet in the near term that will help raise investor sentiment (meaning its share price). Also, a clear understanding of when the company will be cash flow positive and not need any more cash injections is critical.

3. Small Caps: Look at the Small Cap share price and chart

The graph of a company's share price always tells an interesting story. Although the Small Cap share chart won't tell you how to invest for the long term, it gives the best idea of the sentiment that any given stock/sector/market has experienced over differing time frames. This is a big aid in timing a decision to jump into or out of a company and whether it is regarded overall as a consistent performer by the investment community.

Our Small Cap cap analysts, or for other investors who are looking to delve a little further look at the beta of a company, that is, how it is correlated against the market. But I believe that the one-year and five-year charts are good enough indicators of investor sentiment.

Under the Radar Report gives you clear Buy, Sell and Hold recommendations for all our small cap stocks. Each week we tell you which stocks have changed recommendation so it is very easy to keep up to date and to take action when you need to.

4. Small Caps: Management is important

Whether talking to management or not, it is important to gauge their performance. A Small Cap investor needs coherent explanations of past performance as well as what their plans are for the future. Management needs to both talk the talk and walk the walk.

Our analysts interview management of the Small Cap stocks we cover.

5. Small Caps: Bull Points/Bear Points

What are the positives and negatives of the small company from an investors perspective? Our analysts are independent and Under the Radar Report does not take leads or publish PR! Our analysis is all from the ground up and we write the bull and bear points objectively.

6. Small Caps: Valuation methodologies

For an investor, everything really comes down to this. Having a clear idea of what a company's valuation is makes it easier to make buy and sell decisions. Our decisions are assisted using valuation methodologies such as price earnings multiples and analysing the present day value of near-term forecast cash flows.

7. Small Caps: Where is the Catalyst?

What will happen in the future that will lead to a stock moving towards the valuation we have chosen? Underlying this is the primacy of timing. In investing timing is important, although rarely do people get it right. We have a belief that the main thing to do is to buy and hold. Patience is one of the biggest virtues and investor can have.