Small Cap Research

Small Caps + FNArena Research

12 Month Access to Under the Radar Report: Small Caps + FNArena

$697.00 / year

You’re looking for serious share price growth and a few small penny stocks that you buy cheaply to bring big returns.

With a $2,000 investment you could buy 20,000 shares at 10c per share. Then if the stock price rises to 15c it’s now $3,000. For the same investment you could buy 20 CBA shares. At +50c per share you’ve $2,000 into $10,000.

Turn

$1000

Into:

Founded in 2011.

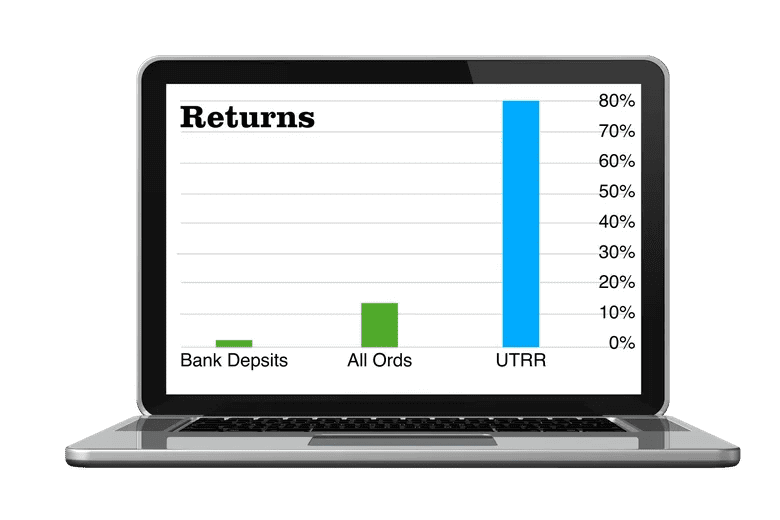

Average return on all 300 Small Caps

Stocks Taken Over

Penny stocks offer Australian investors affordable entry points with the potential for big returns—if you know where to look.

We’ve got you covered. Our team at Under the Radar Report does the deep research, uncovering hidden gems in the ASX so you can invest with confidence. With our expert insights, reduce your risk and discover the most promising penny stocks today.

80% average return: Strong track record since 2011.

Since 2011, 7 out of 10 stocks have made money for our members.

20 % of our small cap stocks have been taken over delivering big share price spikes.

12 Month Access to Under the Radar Report: Small Caps + FNArena

$697.00 / year

Penny Stocks literally means the shares cost a few cents and are certainly well under $5 a share. Penny stocks refer to the share price, not the company’s overall value.

There are lots of ASX micro-cap or small cap stocks that are ‘penny stocks’ because they are under $5.

Penny stocks refers to the share price, not the company’s overall value. Small cap stocks, on the other hand, are defined by their market capitalization, which is the total value of the company.

Small Caps or micro-cap stocks are defined by how much the whole company is worth or it’s total market cap. The price of penny stocks doesn’t tell you the market worth of the company you are investing in or the size or value of the entire company.

That is why classic penny stocks are generally considered highly speculative investments because it is simply the companies that trade with a very cheap share price and the share price is highly volatile.

Most investors are looking for stocks to buy that are smaller companies trading for less than $5 but that have a market cap over $50-$100 million for increased liquidity as under this valuation the stocks are often thinly traded and are higher risk. It’s hard to get your money out.

Penny stocks are prized for their rapid growth. With just a few well-chosen investments, you could double or triple your returns and significantly outperform the market.

You can buy small cap shares that are priced cheaply like penny stocks but are more promising companies with a stronger balance sheet and a lower risk profile.

Americans use the term penny stock but in Australia we use small cap stocks or micro caps.

They are typically considered to be volatile with a buyers beware tag. But with quality independent research, there is serious money to be made no matter your risk profile.

At Under the Radar Report we focus on the ‘sweet spot’ of ASX stocks with a market cap from around $50 million to about $500 million.

In this space there are still lots of ASX penny stocks with a stock price of well under $1 (over 50% of the ASX small cap stocks we recommend fall into this category) and the other 50% are under $5.

Only occasionally do we recommend an ASX stock with a price tag of over $5 per share.

I am text block. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Don’t buy a penny stock just because you are buying it for a couple of cents and it’s cheap. It’s not a gamble you are making. You can remove risk through proper fundamental research and analysis. We do the financial analysis so you don’t have to.

Penny Stocks are renowned for their high risk profile. You often read about a penny stock that offers huge, unbelievable returns or at the other extreme that people crash out and lose their money. How can you reduce your risk?

A good benchmark is to look at the value of the company as a whole. The bigger the market cap the bigger the company.

ASX share investors are all after serious share price growth and a few small penny stocks that you buy cheaply can really transform the returns in your share portfolio by doubling, tripling and more.

All 100 of Under the Radar Report’s current recommendation of penny stocks were under $5 when we first recommended them. But they are not all penny stocks now! That is the point of penny stocks. They can provide some significant benefits. They offer real returns to really boost your portfolio’s return.

It’s easy to find 100 of the best Australian shares under $1 on the ASX, just subscribe to Under the Radar Report’s services and advice. If you love finding value on the ASX then you will love Under the Radar Report.

Small Caps can’t be forecast easily like Blue Chip stocks. This is because institutional investors have to keep away from Small Cap stock due to investment mandates and low liquidity.

Before you invest in a penny stock simply because it doesn’t cost much, you really need to actually look at the company to see if it is profitable, or at least is on the path to being profitable.

It’s very important to be careful and to invest wisely and to get quality stock research. This is particularly important in Penny Stocks and at the smaller end of the stock market.

The small companies can be high risk because these penny stocks are often unknown and normally always under researched. They don’t have teams of analysts pouring over their financials like you do with the Big ASX Blue Chip stocks.