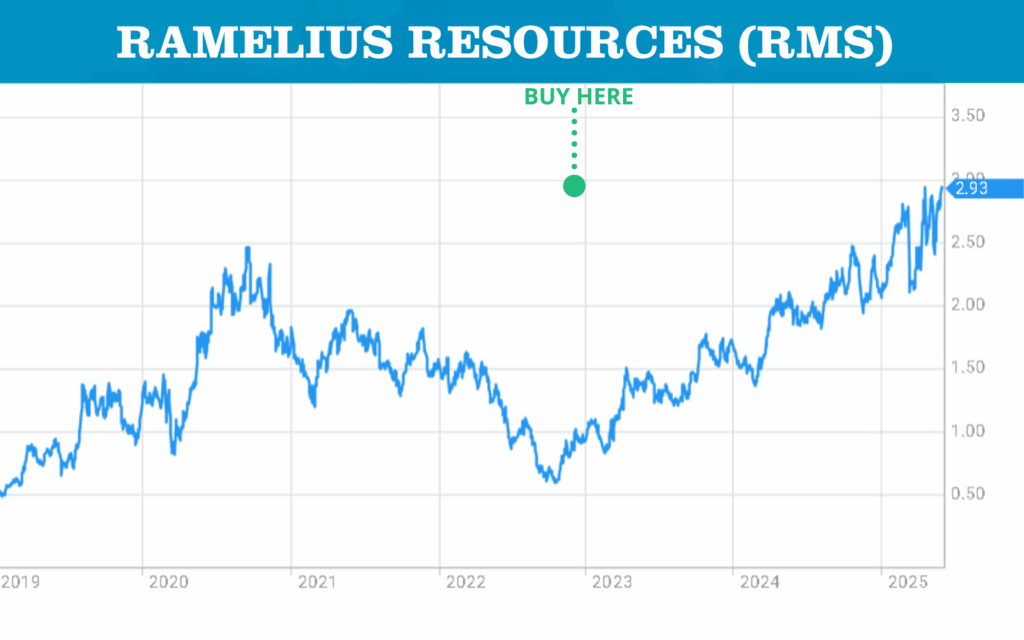

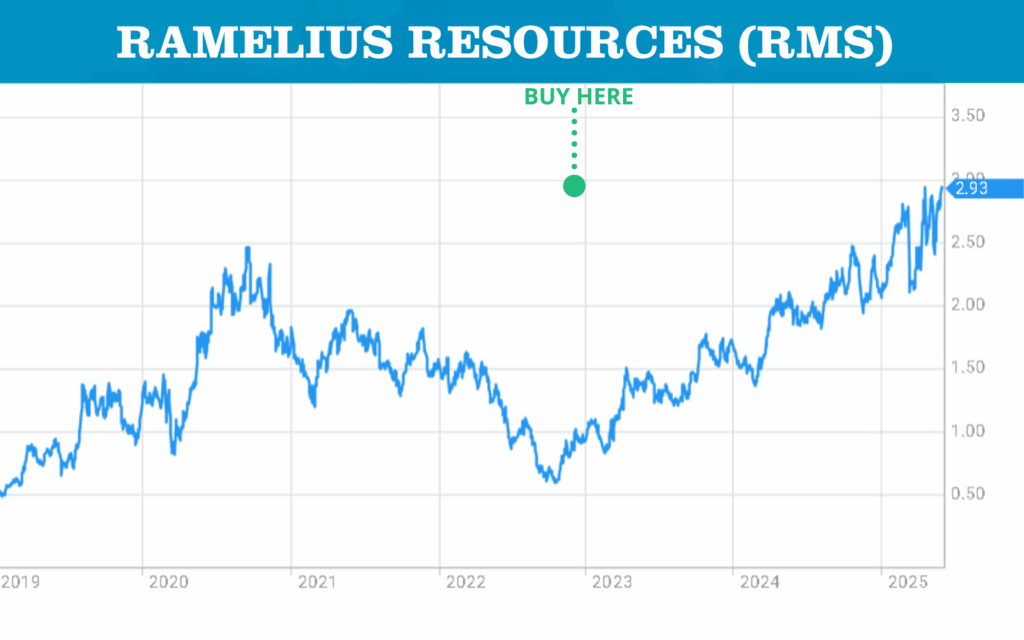

RMS

+225%

Ramelius Resources

First tipped at $0.87 now $2.82!

First tipped at $0.87 now $2.82!

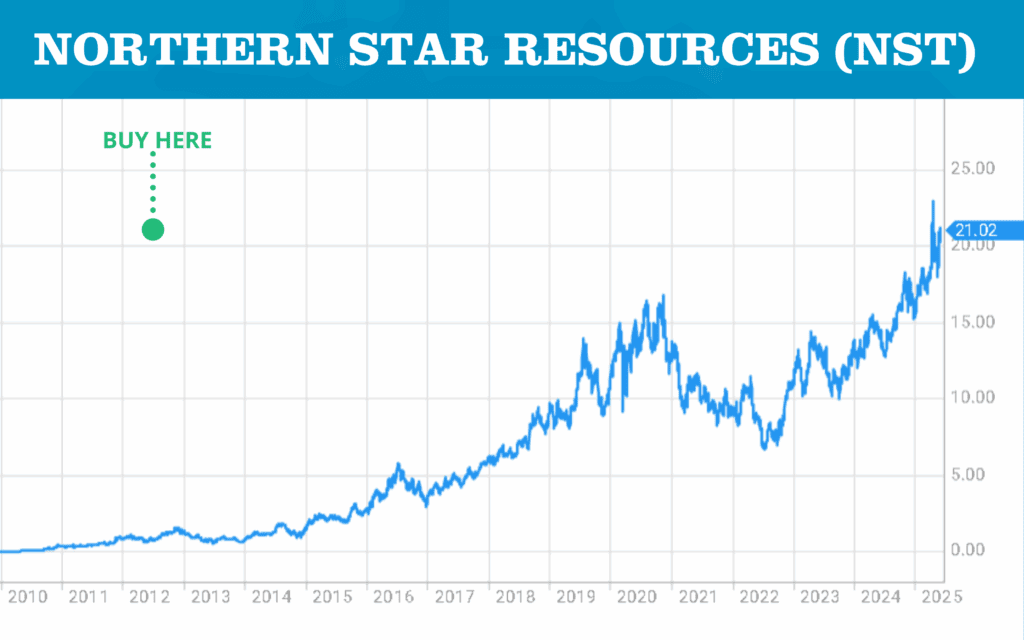

First tipped at $0.83 now $20.50!

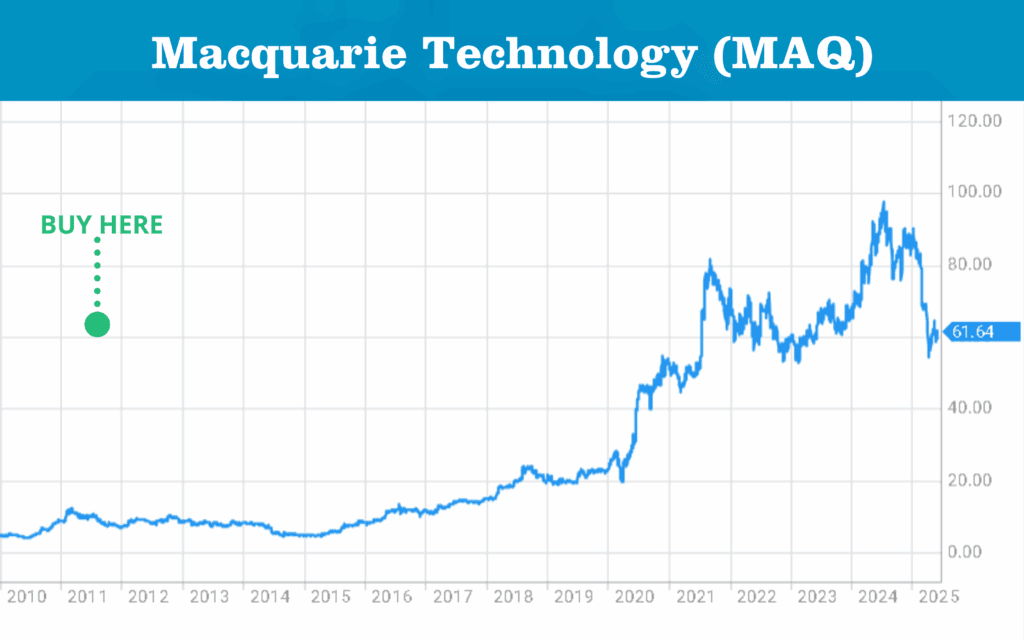

First tipped at $8.15 now $60.53!

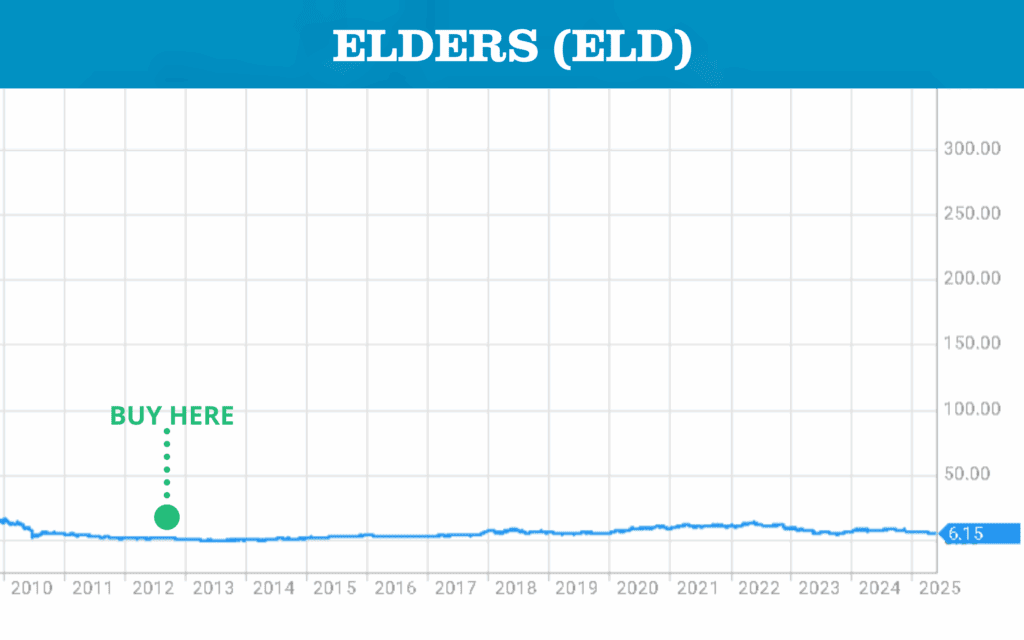

First tipped at $2.15 now $1.47!

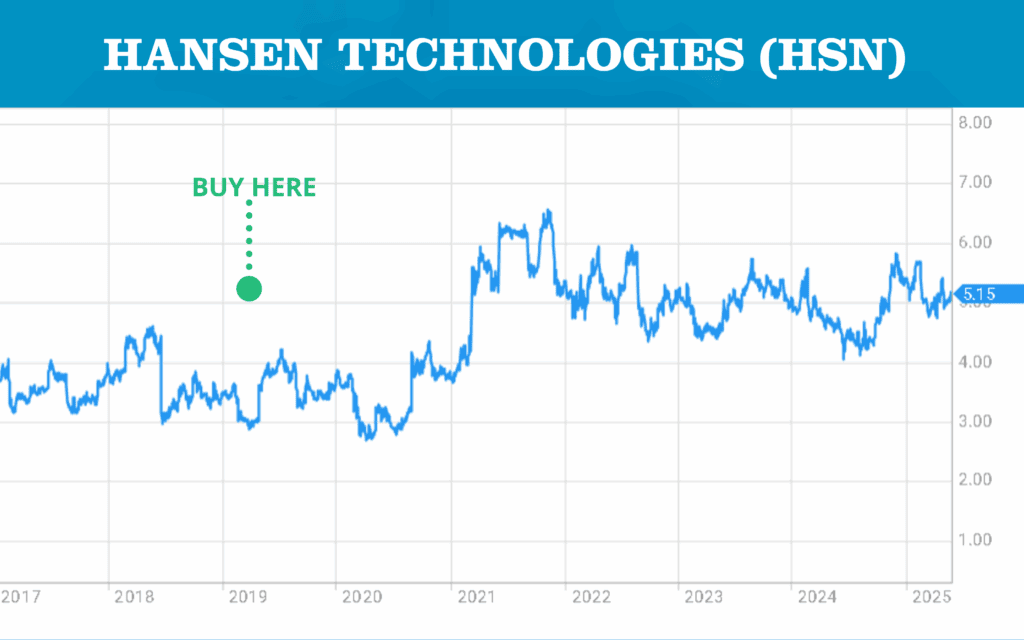

First tipped at $3.01 now $5.15!

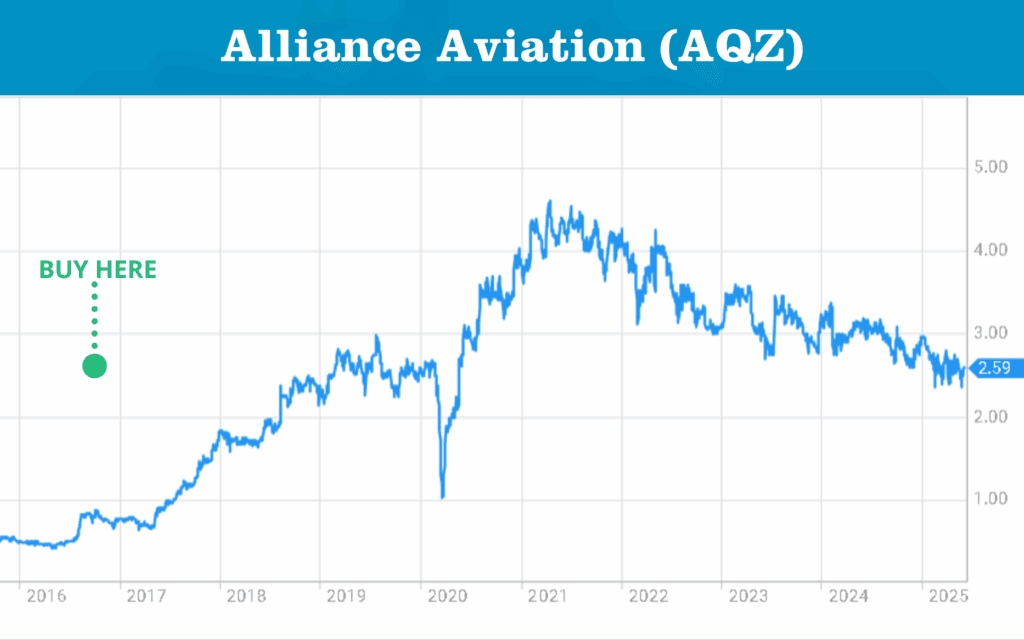

First tipped at $2.50 now $6.23!

First tipped at $0.83 now $2.53!

Richard Hemming

Head of Investments

Rich & Luke break down six turnaround stocks showing real momentum.

AHC, $APX, $RTH, $ATG, $CCA, $NCK?

Hemming shares insights from his own small-cap dividend portfolio, revealing how strategic stock selection and patience can lead to significant returns.

Join for 12 months get 14 months access! Only $697/year.

One click. Cancel anytime.

Accelerate with ASX Small Caps. With over 2,000 stocks to choose from, let us do the hard work for you. With our research, turn $1,000 into ….

Turn

$1000

Into:

Our small cap stocks have delivered.

Our analysts have handpicked the 5 best stocks to buy in 2024.

These top picks focus on companies with a proven track record of delivering value, whether through capital appreciation, dividends, or growth in earnings per share (EPS). Get started for just $50

Small companies tend to offer more growth opportunities compared to the top 50 companies or the blue chip stocks.

The big ETF funds and top index lead fund managers can’t invest in these smaller players until they are big. It’s one of the competitive advantages of individual investors. You can capture exceptional share price appreciation white they grow.

Our past picks, like:

✓ Northern Star Resources (+1,728%) and

✓Pilbara Minerals (+1,076%),

show what can happen when you identify the right stocks early.

Dive into our easy to read summaries and choose the best stocks for your portfolio using our list of Best Stocks To Buy now + risk ratings.

Contact our team now and we’ll come straight back to you.

[email protected]

Congratulations. The most important thing is to start! You can start with as little as $500 and build up your portfolio into a thriving asset, one stock at a time.

Look at our Beginners’ investment guide and we encourage you to start with our $500 strategy.

Our team of market experts filters through over 2,000 stocks and only recommend a stock to buy if they personally would invest in it too. We analyse key metrics including: