Richard is an experienced equities analyst, stockbroker, and financial editor, having worked for over 30 years in finance.

Diversify Your Portfolio Like a Pro

The Impact of the US Fed Rate Cut: Watch Our 6-Minute Breakdown!

Welcome to Getting Rich with Rich! I’m Rich, the founder of Under the Radar Report, and today I want to dive into arguably the biggest market news of the year—the 50 basis point rate cut by the US Federal Reserve.

In this quick 6-minute video, I’ll unpack what this means for your investments and highlight a crucial strategy: diversification.

The Impact of the US Fed Rate Cut

The rate cut was one of the most anticipated moves in financial history, and it sent both equity and bond markets rallying. But the key takeaway here? Diversification.

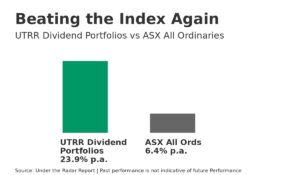

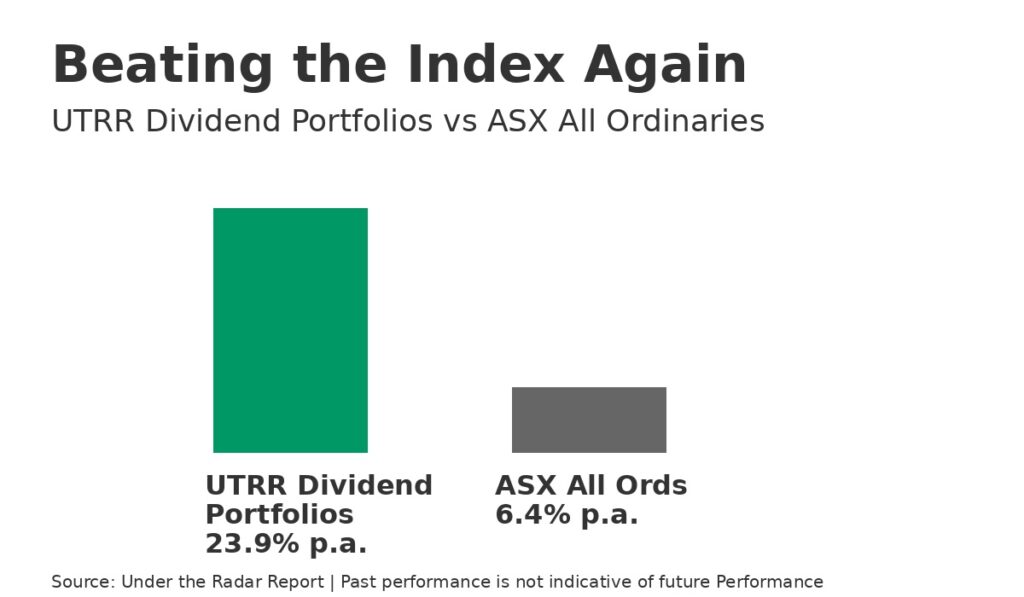

While many investors talk about fixed interest, property, and equities, the real money to be made right now is in equities. To safeguard your financial future and grow your wealth, a balanced portfolio of stocks is essential.

Why Diversification Matters

So, what does it mean to diversify? Here are the three core ways we think about it:

- Diversify by Sector: Our stock picks are carefully organized by sector. This ensures that your portfolio isn’t overly exposed to one industry or trend.

- Diversify by Capital Structure: You want to avoid companies overloaded with debt. Some businesses, like Evolution Mining ($EVN) and Northern Star Resources ($NST), can manage it, but that’s not always the case. A cautionary tale is Insignia ($IFL), which is struggling after acquiring two major businesses, ANZ Wealth and MLC.

- Diversify by Customer: Companies like Austal ($ASB) thrive because they have top-tier customers—the US and Australian Navies. In fact, Austal’s stock is up 25% this week alone, and 60% over the year! It’s a shining example of how a strong customer base can drive performance.

Managing Risk with a Balanced Approach

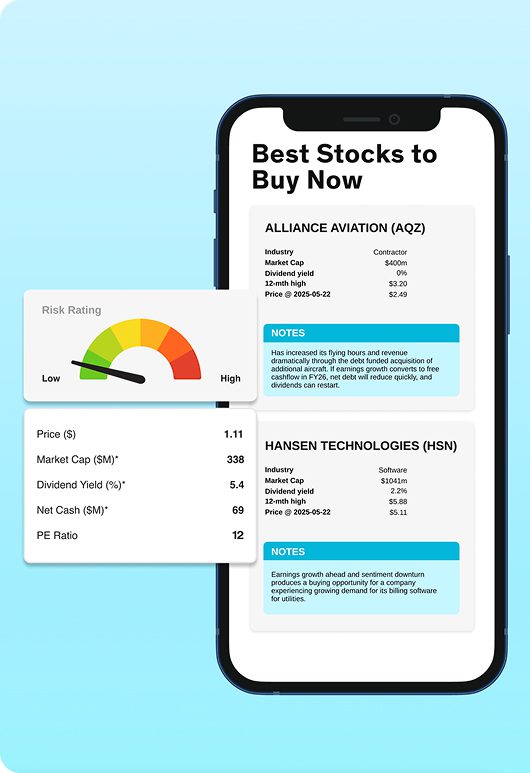

In our small caps publication, we focus on evaluating risk through several factors: balance sheet strength, cash flow, profitability, and customer base. All of this feeds into our Risk Rating, which tells you the level of risk associated with each stock (on a scale of 1 to 5).

Stocks with higher risk ratings, like Mach7 ($M7T) and LaserBond ($LBL), hold smaller positions in my portfolio. It’s okay to own stocks that aren’t performing well, as long as you manage your exposure carefully.

Just like coaching a football team, managing a portfolio requires discipline and attention to performance. Not every player (or stock) will be a superstar right away, but with time and the right strategy, you can build a winning team.

Ready to Dive Deeper?

If you want more insights on how to manage your portfolio like a pro, watch my full 6-minute video above. I’ll also be releasing a special report on banks next week for our Blue Chip members, so stay tuned!

Don’t miss out—our 100 stock research rundown is perfect for anyone looking to get a clear picture of the small-cap landscape and diversify effectively.

Key Points to Watch in the Video:

✓ The significance of the 50 basis point rate cut by the US Fed

✓ Why risk management is the key to successful investing

✓ The importance of diversifying within equities, and what that means

✓ How to use sector, capital structure, and customer base to diversify

✓ The power of our Risk Rating system for evaluating stocks

✓ A sneak peek into our special report on banks for Blue Chip members

Hit play and start diversifying like a pro!

Join Now to get full access to all our expert research and stock recommendations! Maximize your portfolio’s potential with our insights into small caps, blue chips, and more.