Richard is an experienced equities analyst, stockbroker, and financial editor, having worked for over 30 years in finance.

Managing Your Portfolio for Growth and Income with Small Caps

Small Cap Stock Insights: Airtasker, Energy One & MedAdvisor

Our team have been hard at work, analyzing the latest opportunities, and this week’s issue focuses on 12 Small Cap stocks.

I want to highlight four of them, starting with three in the software space: Airtasker (ART), Energy One (EOL), and MedAdvisor (MDR). These companies are exciting secular growth stories, offering potential for strong returns at value prices—similar to getting in early on Apple or Nvidia.

Before we jump into the details, make sure you watch the video included in this blog for an in-depth look at these companies and why we think they’re strong buys right now! Login now to access our full research reports on these stocks.

Managing Your Portfolio: The Importance of Balance

Owning stocks like Airtasker and MedAdvisor, which I personally hold in my portfolio, is great, but managing a successful portfolio requires a mix of different types of investments.

While these software stocks offer big growth potential, a well-rounded portfolio also includes more stable, income-producing stocks.

Take NZME (NZM), for example. This dominant media player in New Zealand might not have the explosive growth potential of Airtasker or Energy One, but it’s a steady performer, paying dividends consistently—even when market sentiment wasn’t strong.

Stocks like NZME add balance to your portfolio, offering stability when more growth-focused stocks experience volatility.

Diving into Software Stocks: Airtasker, Energy One, and MedAdvisor

Let’s start with Airtasker (ART), a well-known online marketplace for jobs. In fact, I’m personally using a Tasker this weekend to build my ping pong table! The business model is straightforward and powerful, benefiting from the network effect in Australia.

People like me can easily find Taskers for odd jobs with just a tap on the app. Airtasker is now expanding into the UK and US, unlocking new growth opportunities.

Although it has lost $42 million over the past four years, it has recently become cash flow positive, indicating the company is heading in the right direction.

Next up is Energy One (EOL), an energy trading software provider. It’s not as well-known as Airtasker, but Energy One is growing steadily, with a 17% increase in revenue from existing operations. Like many B2B businesses, it’s still at break-even at the operating level, but the potential for future growth is huge as the company expands into new markets.

Lastly, there’s MedAdvisor (MDR), an eHealth platform that automates medication management. Similar to Energy One, MedAdvisor builds a scalable software platform with a relatively low fixed cost base. This model allows for significant returns, although the growth can be uneven at times, much like Airtasker’s journey.

Balancing Risk and Reward

The key lesson here is that stocks like Airtasker, Energy One, and MedAdvisor are great additions to a portfolio, but they need to be balanced with more stable investments.

They are riding secular growth trends, which could make them core holdings in the long run, but their volatility means you also need stable, dividend-paying stocks like NZME to provide balance.

What’s Next?

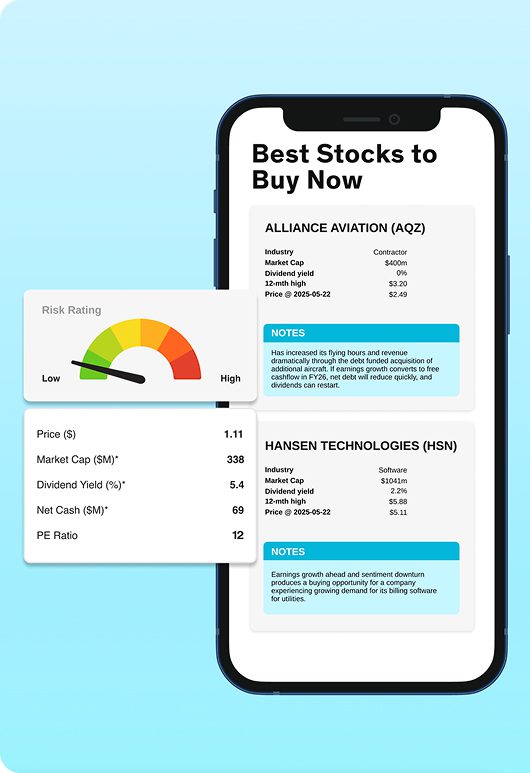

We’ve got a busy week ahead, reviewing over 100 small cap stocks and adding three new stocks to our Best Buys list.

Want to stay ahead of the market? Watch the full video for more insights on these picks and find out why we think they’re poised for growth.

Ready to Join Us?

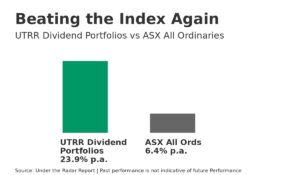

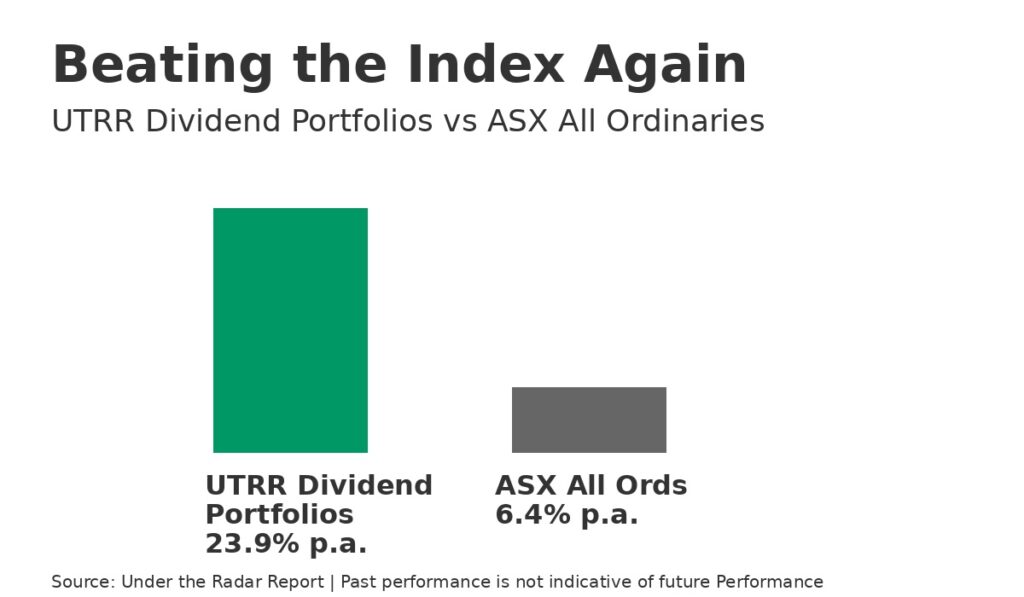

If you’re serious about building a well-rounded, growth-focused portfolio, consider subscribing to Under the Radar Report.

By joining, you’ll get full access to our comprehensive small cap stock research and the opportunity to discover the best growth and income stocks before the market catches on. Don’t miss out—join us today!

Quick Recap:

- Airtasker (ART): Marketplace for jobs, expanding internationally.

- Energy One (EOL): Energy trading software with growth potential.

- MedAdvisor (MDR): eHealth platform for managing medications.

- NZME (NZM): Dominant media company, offering dividends and balance.

Remember, building a portfolio is about balancing growth with income. Watch the video and check out our next issue to stay updated on the best small cap opportunities!