Richard is an experienced equities analyst, stockbroker, and financial editor, having worked for over 30 years in finance.

Unlocking Wealth: Remember To Take Your Profits

Nuclear Stocks Are Running—How to Profit!

Today, I want to dive into my favorite topic—small caps—but first, let’s touch on the market and some breaking news. Watch the video now.

In the past few weeks, we’ve been focusing on nuclear and uranium stocks, and they are really taking off. Just yesterday, Paladin Energy (PDN) surged 11%, Silex Systems (SLX) jumped 14%, and Lotus Resources (LOT) climbed 13%. What’s behind this wave?

Non-members: Please join now to access all our stock research now

It seems the push for clean, reliable energy is gaining momentum, with big tech getting involved. This week, Google struck a deal with Kairos Power, a developer of Small Modular Reactors (SMRs), while rumors suggest Amazon is financing SMR-related development as well. These AI-powered data centers need zero-emission, base-load power—and nuclear energy fits the bill perfectly.

Meanwhile, Lake Energy (LKE), a lithium stock we covered last week, spiked 28% without any news. It’s a reminder of how quickly things can change with small caps!

The Market at Record Levels: What Does It Mean?

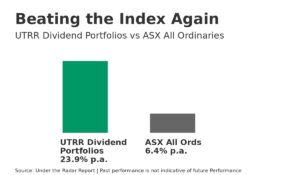

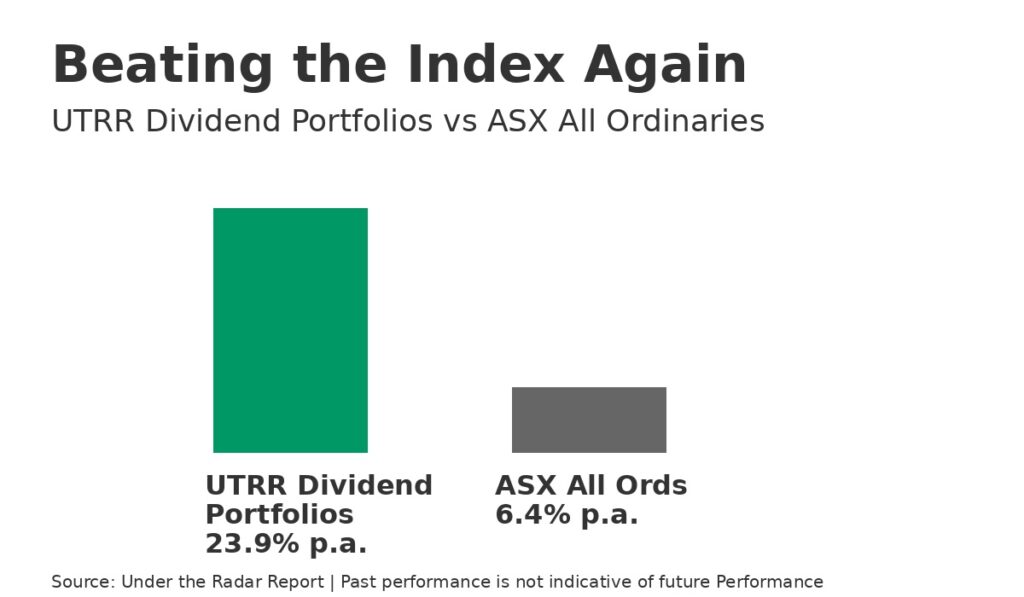

The broader market is trading at record highs, but what does that mean for investors like you? Simply put: diversification is essential. The market is not uniform, and there are always pockets of opportunity. You can’t fully profit from these opportunities without including small-cap stocks. Why? Because these stocks aren’t part of the index and they don’t always rely on the broader economy to grow. They’re disruptors, often operating under the radar until they explode in value.

This brings me to a story that highlights the life-changing potential of small caps. A member recently reached out to share how following our small-cap recommendations allowed him to retire early. He had invested in Vulcan Energy and Kidman Resources on our advice. Kidman was taken over, and he took profits on Vulcan, enabling him to retire—but he still holds some Vulcan stock.

The Big Takeaway: Take Your Profits

These stocks can be boom or bust, so when you’ve made gains, it’s important to lock in profits. At the same time, the high risk, high reward nature of small caps means you should keep your initial investments low. But the potential upside is huge, and that’s why small caps are worth owning.

Why Small Caps Can Be Life-Changing

The secret to why small caps can change your financial life comes down to operating leverage—the ability to grow profits exponentially from a small equity base. Many of the stocks we cover have this potential, and it’s a key reason I love small caps.

The Lesson: Take Your Profits and Diversify

We’re excited about the market right now, and you should be too. But remember, as we hit these record highs, don’t let it make you nervous. What should you do? Diversify, diversify, diversify! Banks, which represent about 40% of the Australian market, don’t include small caps—so you can’t afford to ignore these disruptive stocks if you want a truly diversified portfolio.

And while we talk about diversification, let’s not forget the main reason I love small caps—they have the potential to change your life. Just ask our members who’ve hit it big with our recommendations.

Nuclear Stocks Are Booming

As I mentioned earlier, Google’s deal with Kairos Power, an SMR developer, is part of a larger trend. Big tech companies, including Amazon and Microsoft, are looking for low-emission base-load power to fuel their growing AI data centers. Nuclear energy, and by extension, uranium stocks, are in the spotlight—and the market is reacting.

Key Points for Investors:

- The market is at record highs—what does that mean for you?

- Diversify your portfolio to include small caps.

- Nuclear stocks are running: Yesterday, $PDN +11%, $SLX +14%, $LOT +13%.

- Take your profits! Boom-bust stocks require savvy exits.

- Small caps can change your life—but keep initial investments low.

- The power of operating leverage can drive massive returns.

Needless to say, we’re excited by the opportunities in the market right now. Keep reading our latest reports and remember: unlocking wealth is about taking your profits along the way.