Richard is an experienced equities analyst, stockbroker, and financial editor, having worked for over 30 years in finance.

Three Quality Small Caps:

3 portfolio Management Tips & 3 Quality Small Caps

Today I’d like to start with 3 portfolio management tips. The uncertainty with Trump’s tariffs means it’s important to focus on your portfolio.

Portfolio tip 1:

I always recommend to build up more and buy what you know or already own.

Buy Quality stocks – we look for a big stable blue chip customer base, solid balance sheet and strong cash flow.

Portfolio tip 2

Buy in small increments – with huge uncertainty, you want to limit your spending and build up your holding, using dollar cost averaging.

Portfolio tip 3:

Spread your risk – core & growth

- Diversified across industry, across business type and across size

- You cannot be diversified without small caps

- Look at our dashboard to see our stocks sorted by sector and buy, sell, hold to find our favourite stocks in each sector.

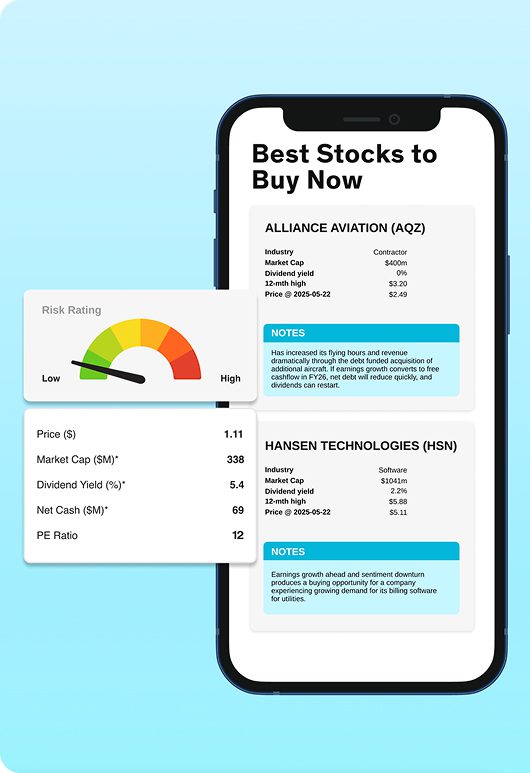

3 Small Caps to Buy Now

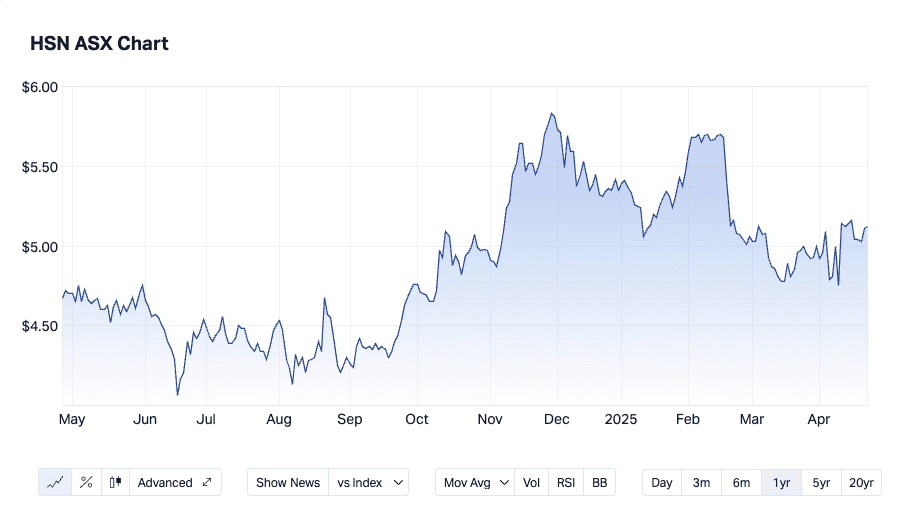

Stock 1: Hansen Technologies $HSN – CORE Portfolio Risk Rating

Hansen Technologies ($HSN) is a high quality business that is in transition. Why is it high quality – customer base, long-term contracts & industry tail wind. Adding plug & play API business from powercloud to its on premise solution. Great value!

Stock 2: Macquarie Technology $MAQ – CORE/GROWTH Portfolio Risk Rating

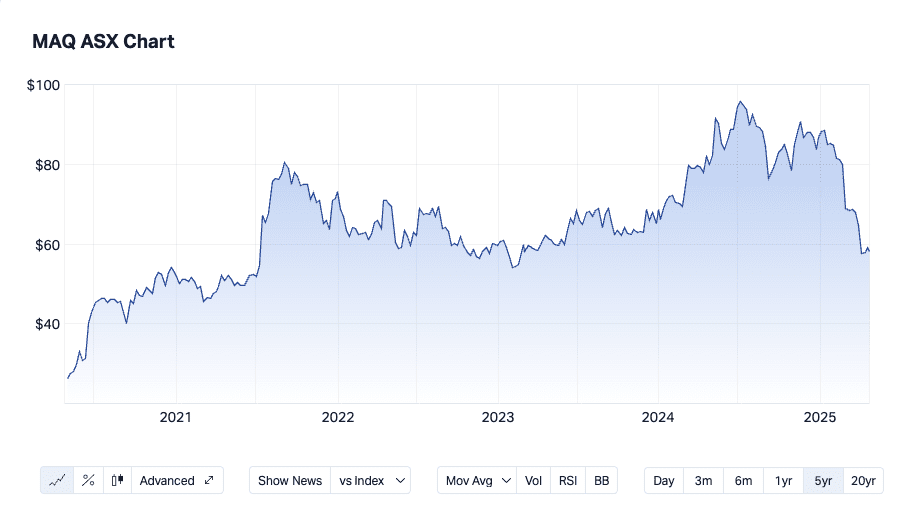

The 5-year chart shows you the buying opportunity for Macquarie Technology now. This stock has been one of our best stocks to buy. We first recommended it around $8.

We all know the benefits of data centres and the ai potential. MAQ is going all in having been a big success. Do they have to? Either evolve or die in tech. The company has founder backing, which has paid off in the past. What they’re doing is three-folding capacity with the new data centre 45MW capacity. They’ve had their first capital raising since the company was floated 25 years ago. Big capex, big debt, big potential

Earnings should follow in 2-3 years following construction. 0nce again it comes back to quality of customer base.

Stock 3: Intelligent Monitoring Group $IMB – Higher risk GROWTH Portfolio Risk Rating

Security systems roll-up – 11 acquisitions in three years. Fractured domestic security market dominated by them after their purchase of ADT. Now no longer hamstrung by debt – refinancing of $80m in debt halving interest bill. Higher risk but roll-up that works – benefit from economies of scale. Cheap!

That’s it and you should check out the stocks we’ve got coming up this week in Small Caps & Blue Chip. We’ve also got our Bonus Blue Chip report on how to invest a lump sum.

Happy Investing

Rich!

Not a member yet? Join Today!