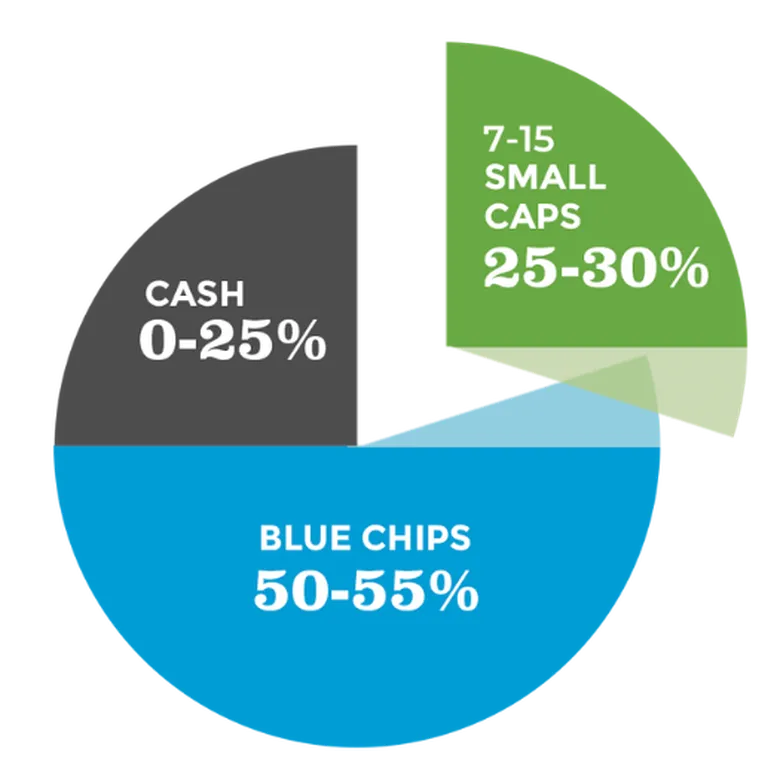

We hold 6 smaller positions in stocks that could become tier 2 or even core.

Power in Small Caps

These stocks can really grow! You never know your luck and these small companies can grow into stable Tier 2 businesses. Small Caps

Each stock is only 0.5% of your portfolio

We have to be readily prepared to lose that sort of money with no regrets. Nobody, not even Warren Buffett or [INSERT THE NAME OF YOUR MOST ADMIRED INVESTOR HERE], gets them all right, even in bull markets.

Don’t invest too much at the start

One key to making money is minimising your losses, which means not investing too much initially. Don’t know how much to invest or how to start? It’s time to follow our investing pathway in Building Wealth From Scratch In the Stock Market. Start with your CORE plan today.

Reduce your risk

A successful investment portfolio is by definition one where your mistakes aren’t big enough to damage below the waterline. We have risk ratings on all our Small Cap stocks to help you manage your risk profile.

Grow your confidence

What am I aiming for with Small Caps?

You want two or three winners, which are currently small companies (or Small Caps), but which have the capacity to become much bigger.

The flip side is that you will have two or three poor performers. The key here is that your losses are limited, but your gains are not.

With smaller positions you can start to build up as your confidence in a stock grows.

New industries

Build up exposure to newer industries, and emerging business models. From our Dashboard you can see each sector and our favourite stocks to buy.