Markets are buzzing with uncertainty after the U.S. Federal Reserve cut rates by 25 basis points. At first we saw a sell-off, followed quickly by a rally that pushed the Russell 2000, Nasdaq, S&P 500 and Dow Jones to record highs. Skittish is the word.

For investors, this is not the time to sit on your hands. When markets are pricing perfection, one misstep from a company can hit the share price hard. That’s why the smartest move right now is to protect your gains and recycle capital into value opportunities.

Why Take Profits Now?

When a stock is trading well above its historical multiples, you have to ask whether the growth outlook justifies that premium. If earnings are slowing but multiples keep expanding, risk builds up fast. Remember: multiples can’t grow forever — trees don’t grow to the sky.

That’s why Under the Radar Report has been taking profits on high-flyers like:

Qantas $QAN

Super Retail SUL

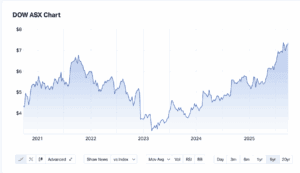

Downer $DOW

These companies have delivered, but the market has already priced in perfection.

Where to Invest Instead?

The flip side is where expectations are low. Companies on lower multiples don’t have to do much to surprise the market — a small earnings beat can lead to both growth and multiple expansion. That’s the “double whammy” of value investing.

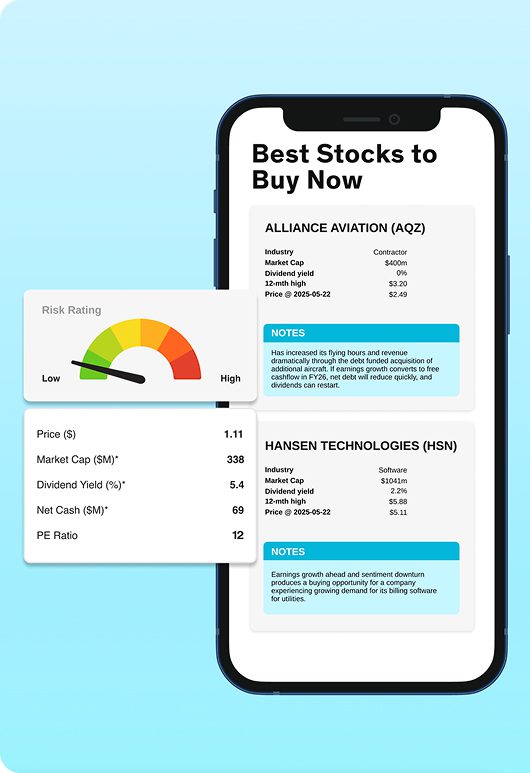

Two stocks we’re backing now:

-

South32 (ASX: S32): A blue-chip miner with exposure to critical minerals like copper, aluminium and zinc. Prices are rising, demand is climbing, and South32 is investing for long-term production growth.

-

Kogan (ASX: KGN): An online retailer in transition. Yes, margins were hit by IT issues, but the long-term plan to move customers into higher-margin services like insurance, telecoms and delivery subscriptions could be transformational.

Protect and Grow Your Wealth

As an individual investor, your advantage is flexibility. You can take profits when valuations get stretched and shift capital into undervalued opportunities. That’s how you protect your portfolio and grow it at the same time.

Our latest Research Rundown covers 90+ small caps, with 28 current buys, plus our top holds and sells. It’s a one-stop shop to help you cut through the noise and focus on value.

👉 Check out our latest Research Rundown