Richard is an experienced equities analyst, stockbroker, and financial editor, having worked for over 30 years in finance.

How to Profit From Market Bubbles: 5 Investment Tips

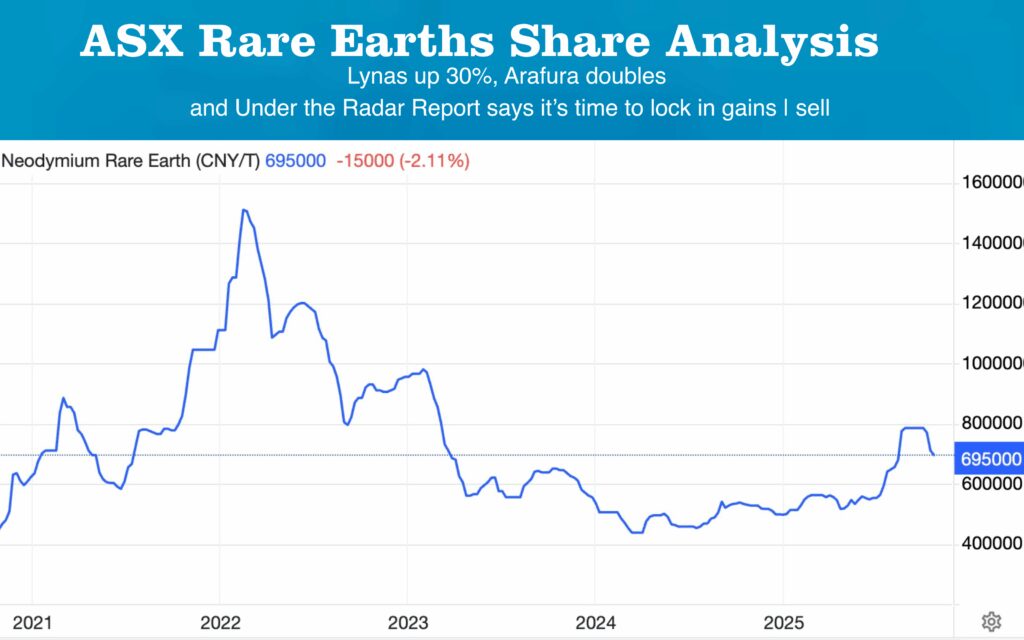

Share markets move in cycles and lately we’ve been moving from one bubble to another. Crypto surged, then corrected. Gold and silver exploded, then cooled. Lithium and uranium are climbing. AI is still running, but now investors are demanding real returns.

When interest rates stay higher for longer valuations come under pressure and weak hands get shaken out. But here’s the key: you don’t just survive bubbles, you profit from them.

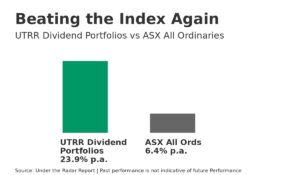

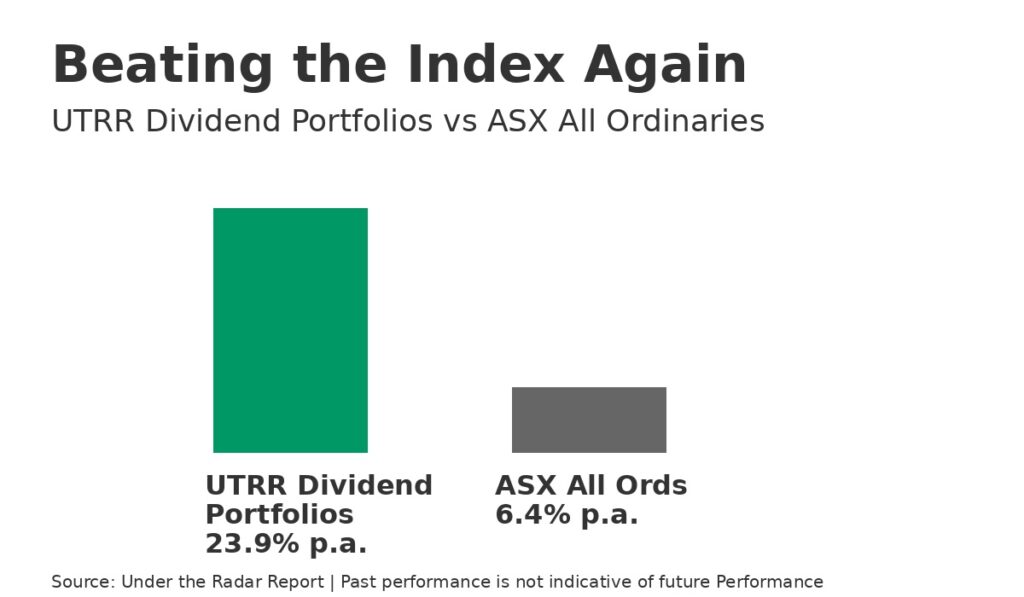

At Under the Radar Report, we use a disciplined framework to turn volatility into opportunity. Here are the five essential steps to profit from market bubbles.

Access your 14-day free trial now

1. Rebalance Regularly (Finance Friday)

The biggest mistake investors make is letting winners run unchecked. We rebalance our portfolio regularly — selling strength and rotating into value. Right now, with increased volatility, we are rebalancing monthly. Try implementing your own Finance Friday:

- Review your portfolio weekly

- Rebalance every 1–2 months

- Sell winners, reinvest into value

- Stay disciplined

Rebalancing protects gains and prepares you for the next opportunity.

2. Take Profits on Big Winners

We were early on gold, lithium and uranium and we’ve been taking profits. In January and February 2026 we:

-

Reduced gold exposure by 40%

-

Trimmed Evolution Mining by 30%

-

Increased cash from 15% → 23%

This doesn’t mean abandoning winners, it means locking in gains and managing risk. Smart investors don’t fall in love with stocks. They harvest profits and redeploy capital in another value small cap stock.

3. Stay Ahead With Sector Analysis

ASX commodities are powerful but they are not set-and-forget. At Under the Radar Report we track:

- Lithium

- Uranium

- Copper

- Gold

- Energy and resources

Understanding the macro cycle helps you:

- Exit near peaks

- Enter before the next run

- Avoid getting caught in downturns

Investors who understand the big picture outperform those chasing headlines.

4. Always Invest in Quality

In volatile markets, quality wins. What defines quality for our investment team?

Strong customer base

Companies with diversified customers are more resilient. But a gold plated customer like the US Government has served ship builder for the US Navy, Austal $ASB well. It was on our Best Stocks to Buy consistently and has delivered big returns for members. We are now taking profits and trimming our portfolio position.

Balance sheet strength

The most important question: Will this company need to raise capital?

Avoid businesses forced to raise money just to survive. Capital raises should fund growth — not rescue.

This is why we prioritise balance sheet analysis above broker noise.

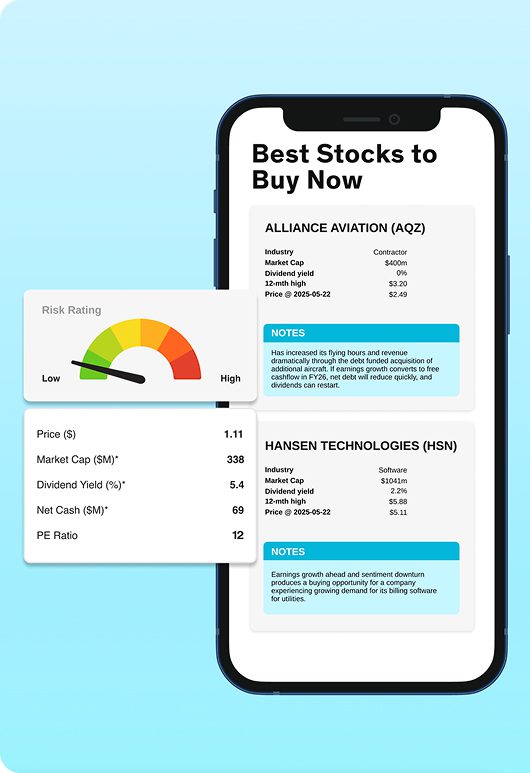

5. Look for Value in Best Buys

Great investing is about risk vs reward. Not every stock works but strong winners outweigh losers. Example: Appen delivered ~75% in six months after we continued backing it through early weakness.

That’s the power of:

- Discipline Research

-

Risk management

-

Patience

The Bottom Line

Markets will always move from bubble to bubble. Volatility is not the enemy, it is the opportunity. Follow these five steps:

-

Rebalance regularly

-

Take profits

-

Stay informed on sectors

-

Focus on quality

-

Buy value with strong risk/reward

Do this consistently and you turn market chaos into long-term wealth.

Want our Best Buys and full portfolio strategy?

Start your 14-Day Free Trial with Under the Radar Report today.