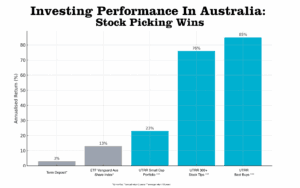

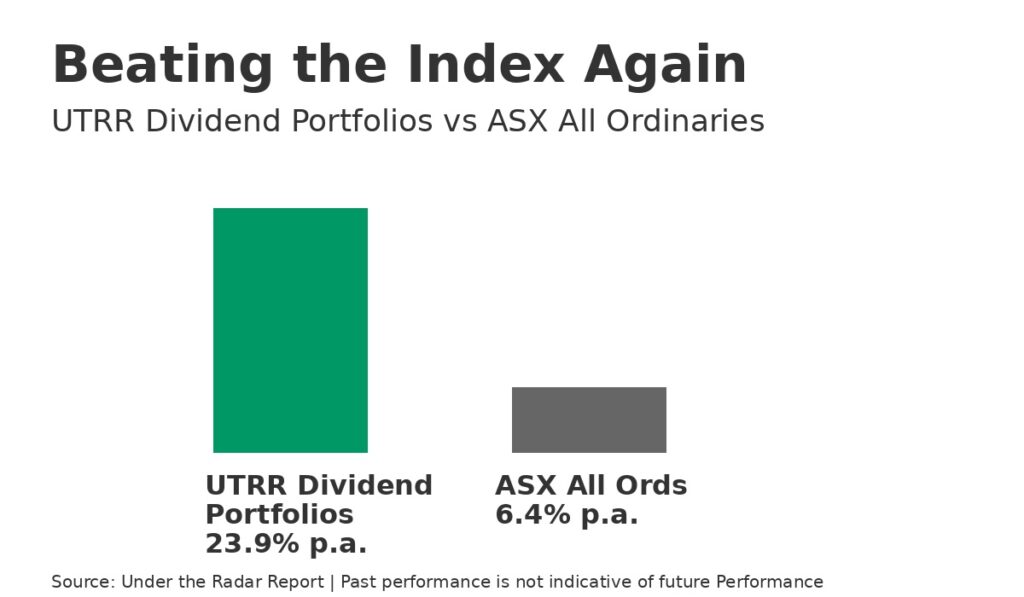

You can generate 24% a year by picking just 14 well-chosen ASX stocks. That’s the power of stock picking over index hugging.

If you’re looking at investing options in Australia, one question keeps coming up.

Should you go with ETF funds like Vanguard—or invest in individual stocks?

Why Picking Stocks Beats Vanguard

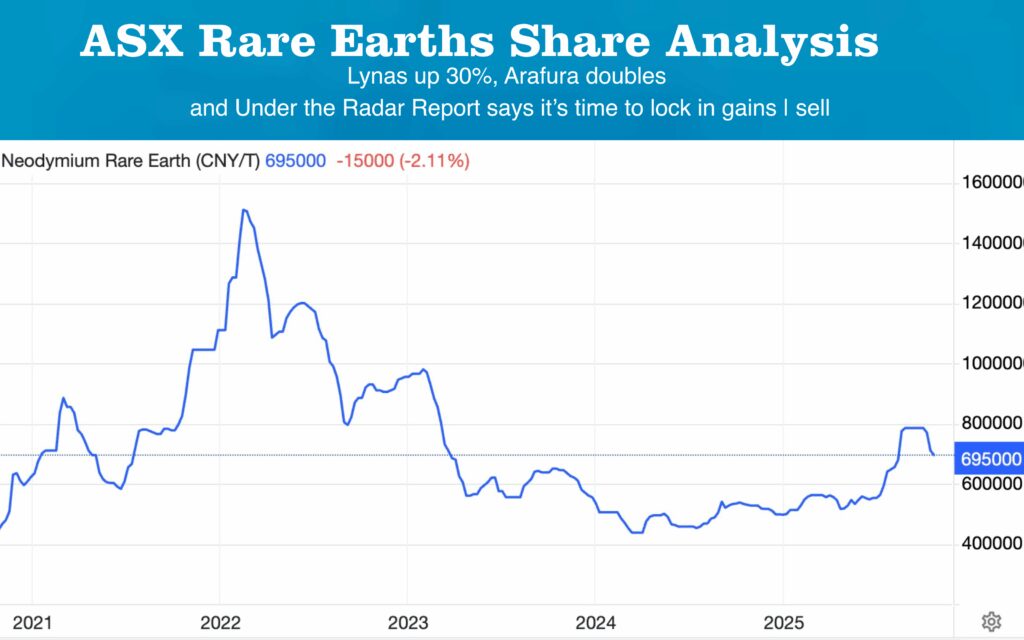

Stock picking offers the opportunity to perform better than the average; a rational fundamental way of ensuring you are tilting the odds in your favour. While there are individual stock risks, there are also individual stock opportunities. Good stock pickers should over time be able to beat ETFs. Though it must be said that in tranquil times, ETFs perform better. But these are not tranquil times.

Individual stocks, like individual investors can outperform the market. Join today.

Stocks airlifted into the ASX200

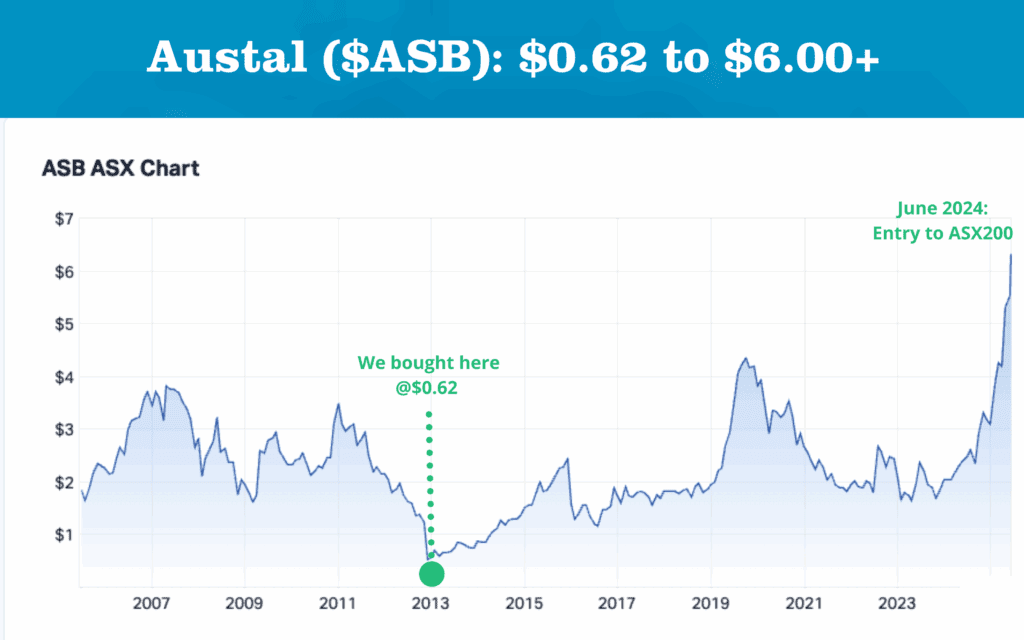

Take the latest additions to the ASX 200: Nick Scali (NCK) and Austal (ASB).

Nick Scali $NCK

We tipped NCK at $1.40 back in 2012—now it trades over $19.

Austal we recommended it at 62 cents in 2013—it’s now above $6.

10x Plus Returns

With dividends included, $NCK and $ASB have delivered 10x-plus returns.

These are classic cases of stock investing in Australia paying off when you think ahead.

So ask yourself: do you want to be an index follower, or an index leader?

We have many examples of individual stocks out performing.

But individuals with a portfolio of shares, how do they perform?

Let’s look at the real number

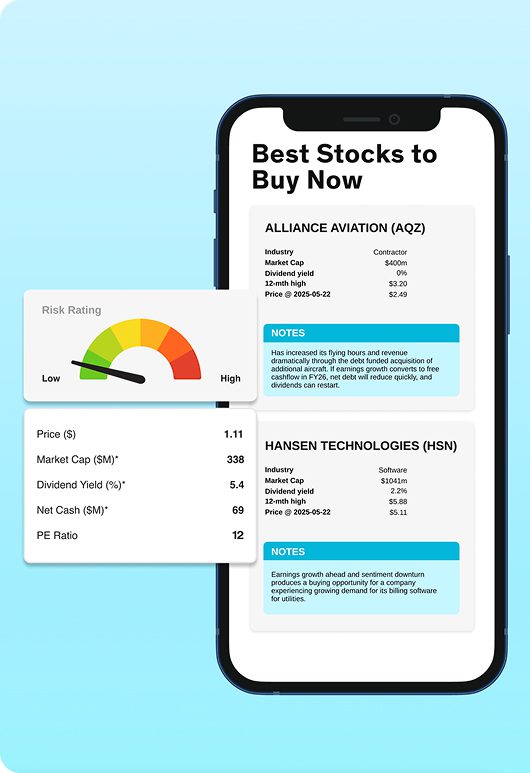

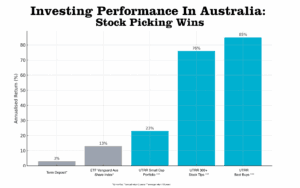

Investing Performance: Stock Picking Wins

| Investment |

Average Annual Return (%) |

| Term Deposit* |

3.0% |

| ETF Vanguard Australian Shares Index* |

13.1% |

| UTRR Small Cap Portfolio** |

22.7% |

| UTRR 300+ Stock Tips*** |

76.4% |

| UTRR Best Buys*** |

85.0% |

*12 months

** annual return over 2 years

*** average return over 13 years

ETFs

There is a role for ETF funds Vanguard, Beta shares and others in a balanced portfolios as set out in our portfolio builder program. In tranquil times ETFs will perform better and they give you instant diversification, They literally track the benchmark index. Vanguard’s annualised returns for 1year is around 13% and 3 years is 9%.

ETFs offer diversification, but the cost of owning everything is that you don’t truly benefit from anything. ETFs track sentiment—not value.In stable markets, ETFs may hold up. But we’re not in tranquil times. And that’s exactly when smart stock investing in Australia gives you the edge